The business has a pipeline of 28 molecules. Consequently Biocon is targeting $1 billion of revenues from the biologics business alone by FY22. This implies revenue growth of about 80% in the next two financial years.

Based on the projected revenues, Biocon Biologics has been valued at three times forward revenues, which some feel is below par. “The valuation should have been northwards of 4 times revenues," says the analyst quoted above.

Perhaps the valuation reflects the current weak conditions of the financial markets. Biocon’s initial plan involved asset monetization through public listing of the biologics unit, according to analysts.

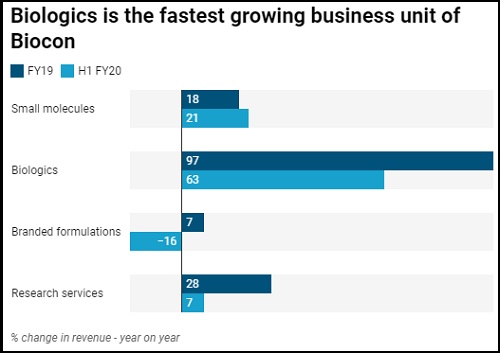

True, some analysts also suspect if the unit will achieve the $1 billion revenue mark by FY22. The implied growth for the next two years is higher than the growth reported in the first half of this fiscal (63%).

Uncertainty about product approvals and launch timelines remains a key risk. “We refrain from revising our estimates to guided targets as they remain contingent on timely / successful execution and potentially underestimates risks arising from any competitive response to Biocon launches and regulatory uncertainties (approval and manufacturing compliance related)," Nirmal Bang Institutional Equities said in a September quarter results review note referring to the $1 billion biologics revenue target.

Most analysts estimate the biologics revenues at best to cross $700 million by FY22. Assuming this to be true, the valuation works out to a little over four times.

The analyst quoted above points out this is still lower than some peers abroad. South Korea based biopharmaceutical firm Celltrion Inc. for instance trades at price to sales ratio of about 22 times.

Compared to chemical based pharmaceutical drugs, biosimilar products have a complex development process which is difficult to emulate. As a consequence, biosimilar products face limited competition, often helping them derive better realizations and valuations.

Yet, while there may be a case that it deserved an even high valuation, being a niche business with limited competition, investors should feel heartened by the fact that the unlocking process has begun.

" />

How much is Biocon Ltd’s fastest growing business segment worth? Based on a $75 millon investment made by a domestic private equity fund, Biocon Biologics India Ltd is worth $3 billion.

Prima facie, this looks like a handsome valuation. All of Biocon was valued at about $5 billion before the deal was announced. And Biocon Biologics, which houses the fast-growing biosimilar business, accounted for less than a third of the company’s consolidated revenues in the first half of FY20. Still, it has been valued at about 60% of the total valuation of the firm.

The biologics business clocked revenue of ₹1,006 crore in first half of the current fiscal, implying annualized revenues of ₹2,012 crore ($280 million). This pegs the valuation at 10.7 times revenues, far higher than 5.6 times revenue multiple investors are currently attributing to the whole company.

But investors were least impressed. Shares of Biocon Ltd lost over 4% on Monday after the company announced the stake sale. “For a business with high entry barriers, the valuation multiple should have been higher," says an analyst with a domestic broking firm who do not want to be named.

The business has a pipeline of 28 molecules. Consequently Biocon is targeting $1 billion of revenues from the biologics business alone by FY22. This implies revenue growth of about 80% in the next two financial years.

Based on the projected revenues, Biocon Biologics has been valued at three times forward revenues, which some feel is below par. “The valuation should have been northwards of 4 times revenues," says the analyst quoted above.

Perhaps the valuation reflects the current weak conditions of the financial markets. Biocon’s initial plan involved asset monetization through public listing of the biologics unit, according to analysts.

True, some analysts also suspect if the unit will achieve the $1 billion revenue mark by FY22. The implied growth for the next two years is higher than the growth reported in the first half of this fiscal (63%).

Uncertainty about product approvals and launch timelines remains a key risk. “We refrain from revising our estimates to guided targets as they remain contingent on timely / successful execution and potentially underestimates risks arising from any competitive response to Biocon launches and regulatory uncertainties (approval and manufacturing compliance related)," Nirmal Bang Institutional Equities said in a September quarter results review note referring to the $1 billion biologics revenue target.

Most analysts estimate the biologics revenues at best to cross $700 million by FY22. Assuming this to be true, the valuation works out to a little over four times.

The analyst quoted above points out this is still lower than some peers abroad. South Korea based biopharmaceutical firm Celltrion Inc. for instance trades at price to sales ratio of about 22 times.

Compared to chemical based pharmaceutical drugs, biosimilar products have a complex development process which is difficult to emulate. As a consequence, biosimilar products face limited competition, often helping them derive better realizations and valuations.

Yet, while there may be a case that it deserved an even high valuation, being a niche business with limited competition, investors should feel heartened by the fact that the unlocking process has begun.

0 thoughts on “Why investors doubt the logic behind Biocon Biologics deal valuation”