The degrowth witnessed in ICICI Pru Life’s business was primarily by design. It decided to focus on small-ticket insurance policies to make its market-linked products more customer-friendly.

However, targeting the average Joe instead of high net-worth individuals with fat pockets and the risk appetite to buy unit-linked products, has its downsides. The life insurer’s new business premium was hit badly in FY19, which continued in the first two quarters of FY20.

Even for the April-December 2019 period, APE growth is nowhere close to the insurer’s historic performance. The underperformance of its stock compared with other listed life insurers reflects this.

The silver lining is the protection business. For the nine-month period of FY20, the firm reported a 66% increase in its protection APE. This comes on top of a 100% jump in protection the year before. Truly, hawking low-cost term insurance plans is paying off for the company.

ICICI Pru Life’s managing director and chief executive N.S. Kannan said the protection business helped raise profitability and is also a preferred line of product for Indians. Indeed, millennials prefer a no-fuss simple life cover to a complex low-yielding traditional plan. Ergo, the savings business of the insurer saw a 4.9% dip.

As protection boosts margins, it was no surprise that value for new business margin came in at an impressive 21% for the nine-month period. Value of new business grew at 24.7%. These two metrics buttressed the rather modest valuations of the life insurer, according to analysts.

ICICI Prudential Life Insurance trades at a modest multiple of nearly three times its embedded value for FY20. This is lower than SBI Life Insurance Co. Ltd and HDFC Life Insurance Co. Ltd, which trade at 3.5 times and 5 times their respective embedded values.

That said, mere modest comparative valuations and profitability metrics won’t make the cut. Investors await ICICI Prudential Life to get back to its historic strong premium growth. Until then, the stock is unlikely to break free from the current modest run.

" />

Investors seem to like ICICI Prudential Life Insurance Co. Ltd’s performance for the first nine months of FY20. On Tuesday, the share price of the private sector life insurer gained in a lacklustre and falling broader market, which was led by financial stocks.

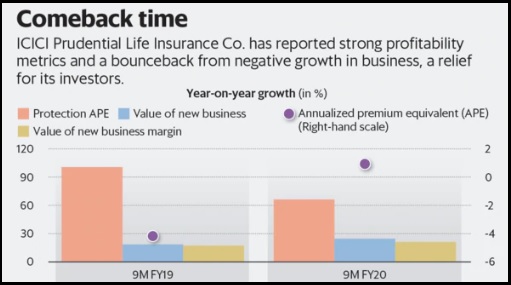

After a troubled FY19, ICICI Pru Life seems to be back on its growth track. Business growth on an annualized premium equivalent (APE) basis revived after shrinking for many quarters. APE growth was 1.2% for the nine-month period compared with a negative 4.2% in the corresponding period of FY19.

The degrowth witnessed in ICICI Pru Life’s business was primarily by design. It decided to focus on small-ticket insurance policies to make its market-linked products more customer-friendly.

However, targeting the average Joe instead of high net-worth individuals with fat pockets and the risk appetite to buy unit-linked products, has its downsides. The life insurer’s new business premium was hit badly in FY19, which continued in the first two quarters of FY20.

Even for the April-December 2019 period, APE growth is nowhere close to the insurer’s historic performance. The underperformance of its stock compared with other listed life insurers reflects this.

The silver lining is the protection business. For the nine-month period of FY20, the firm reported a 66% increase in its protection APE. This comes on top of a 100% jump in protection the year before. Truly, hawking low-cost term insurance plans is paying off for the company.

ICICI Pru Life’s managing director and chief executive N.S. Kannan said the protection business helped raise profitability and is also a preferred line of product for Indians. Indeed, millennials prefer a no-fuss simple life cover to a complex low-yielding traditional plan. Ergo, the savings business of the insurer saw a 4.9% dip.

As protection boosts margins, it was no surprise that value for new business margin came in at an impressive 21% for the nine-month period. Value of new business grew at 24.7%. These two metrics buttressed the rather modest valuations of the life insurer, according to analysts.

ICICI Prudential Life Insurance trades at a modest multiple of nearly three times its embedded value for FY20. This is lower than SBI Life Insurance Co. Ltd and HDFC Life Insurance Co. Ltd, which trade at 3.5 times and 5 times their respective embedded values.

That said, mere modest comparative valuations and profitability metrics won’t make the cut. Investors await ICICI Prudential Life to get back to its historic strong premium growth. Until then, the stock is unlikely to break free from the current modest run.

0 thoughts on “ICICI Pru Lifes profitability metrics impress but biz growth yet to cut ice”