In the December quarter, Asian Paints sold more low-end products, a trend that was seen in the September quarter as well. The question then is whether more volumes are worth chasing when low end economy emulsions deliver similar margins and realisations. According to Shirish Pardeshi, senior analyst at Centrum Broking Ltd, “As long as more volumes are not coming at the cost of margins and there is a shift to the organized segment, it is the right strategy to grab volume market share. Here, it helps that the raw material costs environment is benign."

Note that Asian Paints has improved its gross margins on a year-on-year for three consecutive quarters now. Further, for the December quarter, earnings before interest, tax, depreciation and amortization (Ebitda) margins expanded by 96 basis points to 21.94%. One basis point is one hundredth of a percentage point. Bloomberg’s consensus estimates suggest analysts were expecting an Ebitda margin of only 20.6%.

So while Asian Paints’ revenues may be lower than estimates because of a change in product mix, this hasn’t impacted margins.

Even so, with the company’s shares trading near record highs, it wasn’t surprising that the miss on the revenue growth front led to a 1.7% drop in the company’s shares on Wednesday.

Valuations appear pricey at nearly 50 times estimated earnings for financial year 2021, according to data from Blomberg. “The bright picture is already factored in the share price, leaving little room for further meaningful upsides," said an analyst requesting anonymity.

Even so, there doesn’t seem to be a case for turning bearish on the stock yet given India’s consumption slowdown woes at present. “Despite significant capex over the last two years the company’s’ balance sheet remains strong," point out ICICI Direct analysts.

Be that as it may, remember demand conditions are still challenging. Going ahead, investors would do well to keep a close eye on whether margins sustain at current levels.

" />

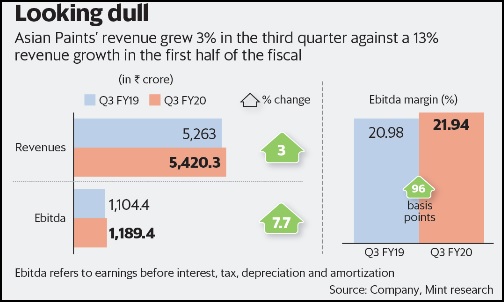

Paint maker Asian Paints Ltd’s December quarter results are not vibrant enough. The problem starts at the revenue line itself, with growth dropping to just 3% last quarter to Rs5420 crore. This is lower than the 13% revenue growth the company reported in the half year ending September. A poll of Bloomberg analysts were expecting December quarter revenues 5% higher at Rs5692 crore.

Sure, the company’s decorative paints segment in India registered a low double digit volume growth, broadly in keeping with Street estimates. “However change in product mix limited the value growth," wrote ICICI Direct Research analysts in a note to clients.

In the December quarter, Asian Paints sold more low-end products, a trend that was seen in the September quarter as well. The question then is whether more volumes are worth chasing when low end economy emulsions deliver similar margins and realisations. According to Shirish Pardeshi, senior analyst at Centrum Broking Ltd, “As long as more volumes are not coming at the cost of margins and there is a shift to the organized segment, it is the right strategy to grab volume market share. Here, it helps that the raw material costs environment is benign."

Note that Asian Paints has improved its gross margins on a year-on-year for three consecutive quarters now. Further, for the December quarter, earnings before interest, tax, depreciation and amortization (Ebitda) margins expanded by 96 basis points to 21.94%. One basis point is one hundredth of a percentage point. Bloomberg’s consensus estimates suggest analysts were expecting an Ebitda margin of only 20.6%.

So while Asian Paints’ revenues may be lower than estimates because of a change in product mix, this hasn’t impacted margins.

Even so, with the company’s shares trading near record highs, it wasn’t surprising that the miss on the revenue growth front led to a 1.7% drop in the company’s shares on Wednesday.

Valuations appear pricey at nearly 50 times estimated earnings for financial year 2021, according to data from Blomberg. “The bright picture is already factored in the share price, leaving little room for further meaningful upsides," said an analyst requesting anonymity.

Even so, there doesn’t seem to be a case for turning bearish on the stock yet given India’s consumption slowdown woes at present. “Despite significant capex over the last two years the company’s’ balance sheet remains strong," point out ICICI Direct analysts.

Be that as it may, remember demand conditions are still challenging. Going ahead, investors would do well to keep a close eye on whether margins sustain at current levels.

0 thoughts on “Asian Paints revenue growth dims in Q3 but profit margins stay bright”