Graphic by Santosh Sharma/Mint

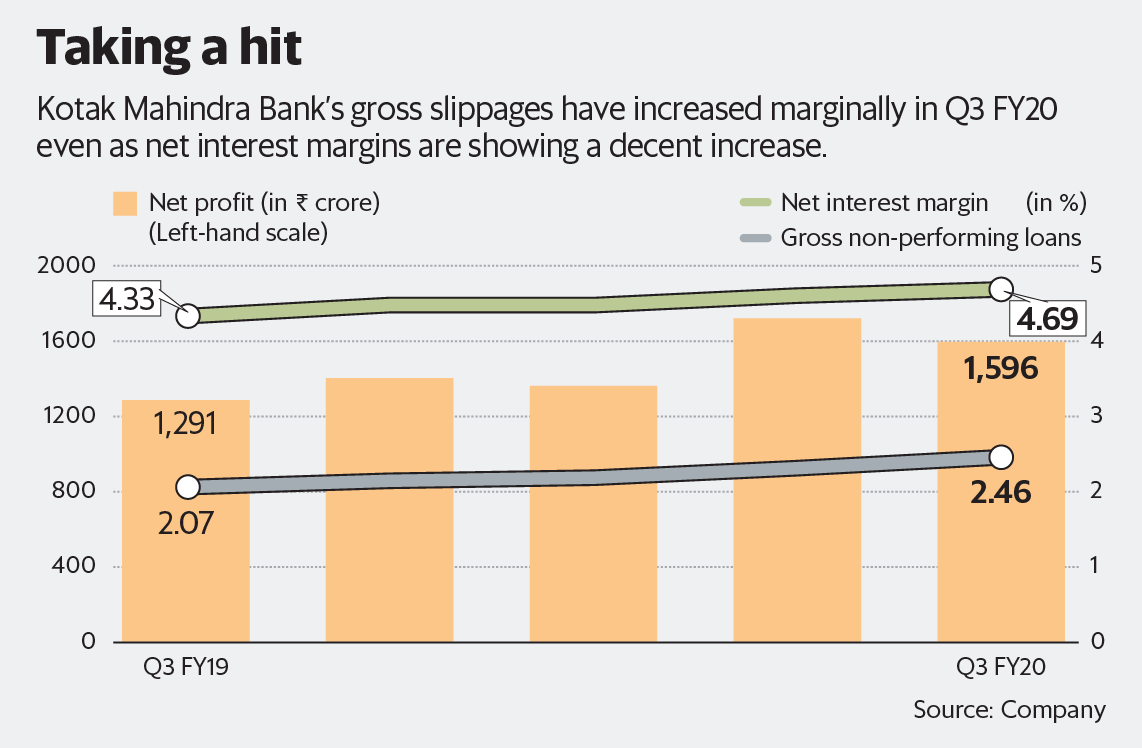

A key reason for the slippage is the increase in gross non-performing loans, which swelled 7.5% q-o-q. Analysts had expected gross non-performing loans to remain largely stable this quarter as the bank scaled back growth rates. Gross non-performing loans increased from 2.32% in Q2 to about 2.46% in Q3.

However, Kotak Mahindra Bank increased provisions towards bad loans to ₹444 crore in Q3, from ₹408 crore in Q2. Thanks to the higher provisions, net non-performing loans stood at about 0.89% in Q3. This is still reasonable and does not show any cause for alarm.

A good thing is that special mention accounts-2 (SMA-2) have reported lower stress, which points out that rising slippages may not be so bad.

Lately, Kotak Mahindra Bank has been conservative in its loan growth, especially given the increased stress in the economy. After all, better safe than sorry. However, it cut back on lending considerably in the commercial vehicle (CV) and construction equipment lending, which pulled down overall loan growth to about 10% y-o-y. Analysts were expecting a loan growth of about 15% y-o-y.

“Credit growth witnessed continued deceleration growing at 10% YoY to ₹2.17 trillion. Marginal moderation was witnessed across all segments, with notable slowdown in the corporate (3% YoY growth) and CV book (5.5% YoY growth)," analysts at ICICI Securities Ltd said in a note to clients

While growth rates may have turned sluggish, valuations could take some cues from the strong core income growth and margins. Net interest margin is at a year’s high of 4.69%, showing that Kotak Mahindra Bank has been able to reduce interest costs and increase low-cost deposits. A positive is net interest income too increased by about 17% y-o-y in Q3.

Even then, the stock is quoting at a multiple of over 5 times its estimated book value for FY21, which is quite rich, especially in the backdrop of slowing growth. A key factor for the disappointment in the stock price has been the slippages. But as SMA-2 is showing less stress this quarter, investors may not have too much cause for worry

" />

Kotak Mahindra Bank Ltd’s investors had priced in a tad better performance by the private sector lender. With the stock having risen handsomely this past year, expectations were running high. But a slip in some of the bank’s operating metrics saw the stock reacting sharply to the results; the Kotak Mahindra stock fell 4.7% on Monday.

The bank’s net profit wasn’t that off the mark than what analysts had estimated. As against ₹1,670 crore stand-alone net profit estimated by analysts (Bloomberg consensus), the lender reported a net profit of ₹1,596 crore in Q3 FY20, an increase of 23.9% year-on-year (y-o-y). However, on a quarter-on-quarter (q-o-q) basis, net profit slipped 7.4%.

Graphic by Santosh Sharma/Mint

A key reason for the slippage is the increase in gross non-performing loans, which swelled 7.5% q-o-q. Analysts had expected gross non-performing loans to remain largely stable this quarter as the bank scaled back growth rates. Gross non-performing loans increased from 2.32% in Q2 to about 2.46% in Q3.

However, Kotak Mahindra Bank increased provisions towards bad loans to ₹444 crore in Q3, from ₹408 crore in Q2. Thanks to the higher provisions, net non-performing loans stood at about 0.89% in Q3. This is still reasonable and does not show any cause for alarm.

A good thing is that special mention accounts-2 (SMA-2) have reported lower stress, which points out that rising slippages may not be so bad.

Lately, Kotak Mahindra Bank has been conservative in its loan growth, especially given the increased stress in the economy. After all, better safe than sorry. However, it cut back on lending considerably in the commercial vehicle (CV) and construction equipment lending, which pulled down overall loan growth to about 10% y-o-y. Analysts were expecting a loan growth of about 15% y-o-y.

“Credit growth witnessed continued deceleration growing at 10% YoY to ₹2.17 trillion. Marginal moderation was witnessed across all segments, with notable slowdown in the corporate (3% YoY growth) and CV book (5.5% YoY growth)," analysts at ICICI Securities Ltd said in a note to clients

While growth rates may have turned sluggish, valuations could take some cues from the strong core income growth and margins. Net interest margin is at a year’s high of 4.69%, showing that Kotak Mahindra Bank has been able to reduce interest costs and increase low-cost deposits. A positive is net interest income too increased by about 17% y-o-y in Q3.

Even then, the stock is quoting at a multiple of over 5 times its estimated book value for FY21, which is quite rich, especially in the backdrop of slowing growth. A key factor for the disappointment in the stock price has been the slippages. But as SMA-2 is showing less stress this quarter, investors may not have too much cause for worry

0 thoughts on “Reality check for Kotak Bank stock as growth slows and slippages rise”