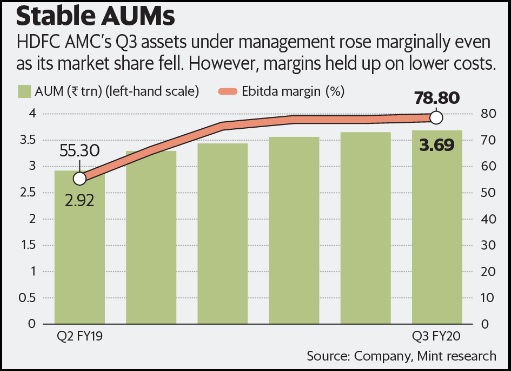

Nevertheless, HDFC AMC increased revenue from asset management fees by a reasonable 10% y-o-y, besides higher advisory fees. Lower expenses and higher operating leverage resulted in the company’s earnings before interest, taxes, depreciation and amortization (Ebitda) increasing by 30% in Q3. Aided by corporate tax cuts, HDFC AMC’s net profit rose about 44% y-o-y. Ebitda margins remained steady at 78.8%, similar to the last two quarters.

SIPs stood at ₹1,220 crore a month. In the monthly SIP market, the fund house has about 14.3% market share. HDFC AMC also has about 15.5% individual market share in Q3, which held steady over Q2.

“HDFC AMC has a highly profitable product mix, given its share of individual equity and balanced schemes in total AUMs. Individual flows tend to be sticky while equity segments enjoy higher margins," said analysts at Nirmal Bang Equities Pvt. Ltd in a client note.

According to the management, the overall penetration of mutual funds is low as equity is significantly under-allocated by investors. Nevertheless, shares are trading at stiff valuations. Much will depend on how individuals continue with equity and mutual fund investments given the volatility in the markets. Trailing 12-month price-earnings multiple is high at 52 times earnings. Any sign of a slowdown in AUMs could take the sheen off its valuations.

" />

The assets under management (AUMs) of mutual fund companies have been inching up steadily, thanks to the steady increase in systematic investment plans (SIPs). HDFC Asset Management Co. Ltd reported steady revenue and profit in line with analysts’ estimates. However, shares were down about 0.5% on Wednesday.

The firm’s AUM grew 12% year-on-year to ₹3.7 trillion, but stagnated on a quarter-on-quarter basis, rising just 0.7%. This was due to outflows in the liquid segment at the fag-end of the year, as is often the case.

HDFC AMC has an edge in the equity AUM segment, which aids its revenue mix. Market share on active funds has remained steady at 15.6%. However, overall market share declined on a closing AUM basis from 14.9% in Q2 to 13.9% in Q3, and should be watched for consistency in the coming quarters.

Nevertheless, HDFC AMC increased revenue from asset management fees by a reasonable 10% y-o-y, besides higher advisory fees. Lower expenses and higher operating leverage resulted in the company’s earnings before interest, taxes, depreciation and amortization (Ebitda) increasing by 30% in Q3. Aided by corporate tax cuts, HDFC AMC’s net profit rose about 44% y-o-y. Ebitda margins remained steady at 78.8%, similar to the last two quarters.

SIPs stood at ₹1,220 crore a month. In the monthly SIP market, the fund house has about 14.3% market share. HDFC AMC also has about 15.5% individual market share in Q3, which held steady over Q2.

“HDFC AMC has a highly profitable product mix, given its share of individual equity and balanced schemes in total AUMs. Individual flows tend to be sticky while equity segments enjoy higher margins," said analysts at Nirmal Bang Equities Pvt. Ltd in a client note.

According to the management, the overall penetration of mutual funds is low as equity is significantly under-allocated by investors. Nevertheless, shares are trading at stiff valuations. Much will depend on how individuals continue with equity and mutual fund investments given the volatility in the markets. Trailing 12-month price-earnings multiple is high at 52 times earnings. Any sign of a slowdown in AUMs could take the sheen off its valuations.

0 thoughts on “HDFC AMC clocks a steady Q3 but the stock remains pricey”