One man’s poison is another man’s meat Ever since the Supreme Court pronounced its verdict on licence and spectrum fee dues by telcos to the government, shares of Vodafone Idea Ltd have fallen by 48% to a mere ₹2.95 per share. Meanwhile, shares of Bharti Airtel Ltd have been resolute at the ₹360 levels.

It’s not that Airtel has not been affected. On Thursday, while announcing its September quarter results, the company said it has provided for a liability of ₹34,260 crore ($4.8 billion), in keeping with the apex court’s directions on calculating its dues. Airtel had cash, cash equivalents and investments worth ₹18,473 crore at the end of September 2019. Its net debt stood at ₹1.18 trillion. Undoubtedly, its leverage ratio will spike as a result of the order.

Airtel’s investors are, however, taking courage from the fact that even in the worst-case scenario, that is, even if it does not get any relief from the government, the Sunil Mittal-led telco will stand to gain market share, which will result from the exit of Vodafone Idea from the market.

Besides, if the government provided significant relief, Airtel still stands to gain. For stock markets, therefore, Airtel is far better placed. Vodafone Idea, in turn, reported a ₹44,150 crore liability, and a cash balance of around ₹15,390 crore.

The government has asked telcos to pay the dues within the three-month deadline set by the Supreme Court, which ends in end-January.

Airtel’s leverage ratios are far better than Vodafone Idea’s and it is expected to have better access to funding to pay the dues demanded by the government. The firm’s stronger financial position is also reflected in its better financial performance.

Airtel reported 3% sequential increase in Ebitda (earnings before interest, tax, depreciation and amortization) on the back of 1% growth in revenue. Most analysts were projecting a sequential fall in operating earnings, with Q2 being a seasonally weak quarter.

Vodafone Idea, on the other hand, reported an 8.3% sequential decline in Ebitda on a like-to-like basis, on the back of a 3.8% fall in revenue. The company’s weak network is resulting in market share losses.

Part of Airtel’s gains in profitability were due to a one-off recovery in bad debt, although the quantum of the write-back was not revealed by the company.

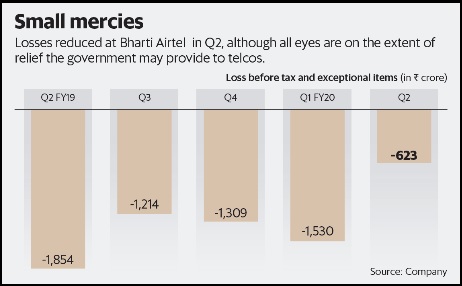

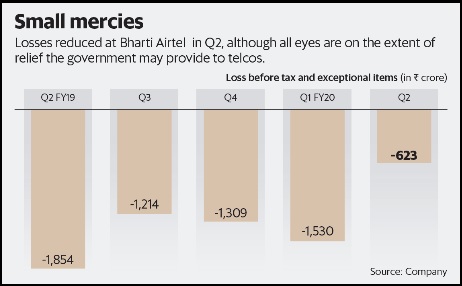

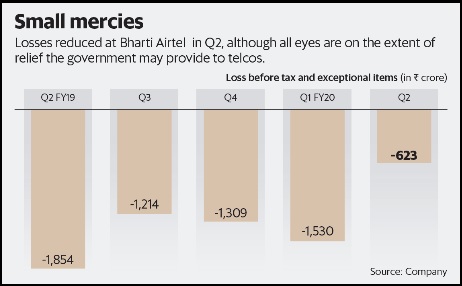

The improvement in sequential performance considerably reduced operating losses (i.e. losses before interest and tax) at the company’s India mobile services unit. As a consequence, the loss before tax at the consolidated entity more than halved sequentially to ₹623 crore.

But these changes of a few hundred crore in quarterly losses are insignificant in light of the larger issue of government dues and the possibility of a relief package. News flow on the extent of relief and the possibility of a duopoly market will determine the direction of the Airtel stock.

" />

One man’s poison is another man’s meat Ever since the Supreme Court pronounced its verdict on licence and spectrum fee dues by telcos to the government, shares of Vodafone Idea Ltd have fallen by 48% to a mere ₹2.95 per share. Meanwhile, shares of Bharti Airtel Ltd have been resolute at the ₹360 levels.

It’s not that Airtel has not been affected. On Thursday, while announcing its September quarter results, the company said it has provided for a liability of ₹34,260 crore ($4.8 billion), in keeping with the apex court’s directions on calculating its dues. Airtel had cash, cash equivalents and investments worth ₹18,473 crore at the end of September 2019. Its net debt stood at ₹1.18 trillion. Undoubtedly, its leverage ratio will spike as a result of the order.

Airtel’s investors are, however, taking courage from the fact that even in the worst-case scenario, that is, even if it does not get any relief from the government, the Sunil Mittal-led telco will stand to gain market share, which will result from the exit of Vodafone Idea from the market.

Besides, if the government provided significant relief, Airtel still stands to gain. For stock markets, therefore, Airtel is far better placed. Vodafone Idea, in turn, reported a ₹44,150 crore liability, and a cash balance of around ₹15,390 crore.

The government has asked telcos to pay the dues within the three-month deadline set by the Supreme Court, which ends in end-January.

Airtel’s leverage ratios are far better than Vodafone Idea’s and it is expected to have better access to funding to pay the dues demanded by the government. The firm’s stronger financial position is also reflected in its better financial performance.

Airtel reported 3% sequential increase in Ebitda (earnings before interest, tax, depreciation and amortization) on the back of 1% growth in revenue. Most analysts were projecting a sequential fall in operating earnings, with Q2 being a seasonally weak quarter.

Vodafone Idea, on the other hand, reported an 8.3% sequential decline in Ebitda on a like-to-like basis, on the back of a 3.8% fall in revenue. The company’s weak network is resulting in market share losses.

Part of Airtel’s gains in profitability were due to a one-off recovery in bad debt, although the quantum of the write-back was not revealed by the company.

The improvement in sequential performance considerably reduced operating losses (i.e. losses before interest and tax) at the company’s India mobile services unit. As a consequence, the loss before tax at the consolidated entity more than halved sequentially to ₹623 crore.

But these changes of a few hundred crore in quarterly losses are insignificant in light of the larger issue of government dues and the possibility of a relief package. News flow on the extent of relief and the possibility of a duopoly market will determine the direction of the Airtel stock.

0 thoughts on “Why investors are taking a 4 bn blow to Bharti Airtel in their stride”