The management expects performance to recover in the second half of FY20, helped by better execution. “Q2 (has) always (been) bad because it is a rainy season and this time unfortunately the rains were very heavy across the country. So, we cannot infer that the position in Q2 had slipped. Q3 and Q4 you will see our performance improving sharply," the management responded to a question during an investor call last week. Still, the Street is not convinced.

At the core of the problem are the redevelopment projects constituting as much as ₹21,000 crore of NBCC’s order book. Work on these projects is stuck due to delay in final approvals and court stays. Add to these the slow progress of railway station redevelopment projects worth as much as ₹34,000 crore of the ₹80,000 crore order book, stuck at various stages.

In the remaining order book, the company awarded ₹25,000 crore of contracts and plans to tender ₹5,000 crore in the second half of FY20 . This should help it regain the revenue momentum in the second half, the management told analysts on 15 November. Project awards can increase substantially if the Nauroji Nagar redevelopment project in Delhi receives the green signal.

Even then, a worry is that awarded tenders are lagging execution timelines. “Within ₹25,000 crore of work awarded to contractors, the nature of work seems to have spilt over from the execution schedule. Here, the management admits a lull phase; however, shies from detailing it," Antique Stock Broking Ltd said in a note.

The fear of slower execution may weigh on revenue expansion. How quickly the management steers the execution will determine the NBCC stock’s recovery.

" />

1.png)

Shares of NBCC (India) Ltd fell 2.8% on Tuesday despite the state-run company winning a new order from the government. The ₹500 crore project will add to the consultancy firm’s order backlog of ₹80,000 crore.

In fact, the stock has lost more than half its value since March 2017, even while order backlog has been growing. This is in sharp contrast to the rally the stock used to witness previously. In two years to April 2015, an increase in order backlog of 49% led the stock to rise 7.6 times.

NBCC remains a preferred consultant for the government’s redevelopment projects. It earns a fixed fee for project management consultancy (PMC), assuring revenue flow. However, as investors learnt the hard way, revenues were not following in line with order inflows.

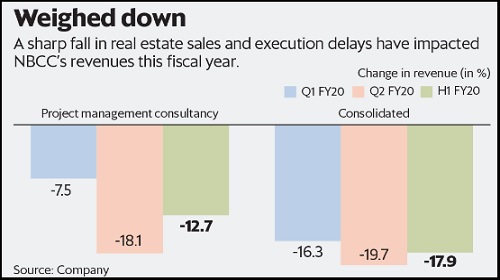

Revenues at the PMC division dropped 12% in the first six months of FY20. Consolidated profit before tax almost halved—down 47% from a year earlier. Its real estate unit posted an operating loss. Performance deteriorated after absolute revenues at the PMC division grew 61% during FY17-FY19.

The management expects performance to recover in the second half of FY20, helped by better execution. “Q2 (has) always (been) bad because it is a rainy season and this time unfortunately the rains were very heavy across the country. So, we cannot infer that the position in Q2 had slipped. Q3 and Q4 you will see our performance improving sharply," the management responded to a question during an investor call last week. Still, the Street is not convinced.

At the core of the problem are the redevelopment projects constituting as much as ₹21,000 crore of NBCC’s order book. Work on these projects is stuck due to delay in final approvals and court stays. Add to these the slow progress of railway station redevelopment projects worth as much as ₹34,000 crore of the ₹80,000 crore order book, stuck at various stages.

In the remaining order book, the company awarded ₹25,000 crore of contracts and plans to tender ₹5,000 crore in the second half of FY20 . This should help it regain the revenue momentum in the second half, the management told analysts on 15 November. Project awards can increase substantially if the Nauroji Nagar redevelopment project in Delhi receives the green signal.

Even then, a worry is that awarded tenders are lagging execution timelines. “Within ₹25,000 crore of work awarded to contractors, the nature of work seems to have spilt over from the execution schedule. Here, the management admits a lull phase; however, shies from detailing it," Antique Stock Broking Ltd said in a note.

The fear of slower execution may weigh on revenue expansion. How quickly the management steers the execution will determine the NBCC stock’s recovery.

0 thoughts on “Why NBCC Indias order wins are no longer exciting its shareholders”