Key benchmark indices extended fall and hit fresh intraday low in early afternoon trade. At 12:15 IST, the barometer index, the S&P BSE Sensex, was down 304.85 points or 0.77% at 39,147.22. The Nifty 50 index was down 100.80 points or 0.85% at 11,722.50. Most realty stocks fell.

Trading for the day began on a negative note as domestic stocks edged lower in early trade on selling pressure in index pivotals. Key benchmark indices extended fall in morning trade after an initial decline. Key indices hovered in negative zone in mid morning trade.

Broader markets underperformed the Sensex. Among secondary barometers, the BSE Mid-Cap index was down 0.82%. The BSE Small-Cap index was down 0.97%.

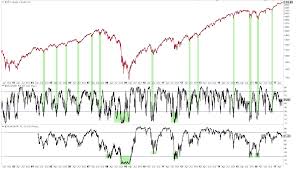

The market breadth, indicating the overall health of the market, was weak. On BSE, 595 shares advanced and 1610 shares declined. A total of 114 shares were unchanged.

Most realty stocks fell. DLF (down 3.49%), Sunteck Realty (down 3.58%), D B Realty (down 2.21%), Oberoi Realty (down 1.57%), Sobha (down 1.17%) and Omaxe (down 0.15%), declined. Peninsula Land (up 1.12%), Phoenix Mills (up 0.99%) and Prestige Estates Projects (up 0.52%) rose.

Dewan Housing Finance Corporation fell 3.6%. Dewan Housing Finance Corporation (DHFL) said that it made a principal payment of Rs 100 crore and interest payment of Rs 25.49 lakh on non-convertible debentures (NCDs) due on 14 June 2019. The announcement was made after market hours on Friday, 14 June 2019.

On the macro front, exports were $29.99 billion in May 2019, as compared to $28.86 billion in May 2018, showing a growth of 3.93%. In rupee terms, exports were Rs 2.09 lakh crore in May 2019, as compared to Rs 1.94 lakh crore in May 2018, registering a growth of 7.36%. Imports were $45.35 billion (Rs 3.16 lakh crore) in May 2019, which was 4.31% higher in dollar terms and 7.76% higher in rupee terms over imports of $43.48 billion (Rs 2.93 lakh crore) in May 2018. The data was announced by the government after market hours on Friday, 14 June 2019.

Overseas, Asian shares were trading mixed on Monday as investors were cautious ahead of a closely-watched Federal Reserve meeting, while political tensions in the Middle East and Hong Kong kept risk-appetite in check.

US stocks ended lower on Friday, 14 June 2019 as investors turned cautious before this week's Fed meeting, while a warning from Broadcom on slowing demand weighed on chipmakers and added to U.S.-China trade worries.

In economic data, industrial production rose 0.4% in May, a solid and broad-based gain helped by increased production of pickup trucks and cars, the Federal Reserve said Friday. It was the strongest monthly rise in six months.

0 thoughts on “Weak market breadth”