Key indices were trading higher after hitting fresh intraday high in morning trade. At 10:24 IST, the barometer index, the S&P BSE Sensex, was up 133.05 points or 0.34% at 39,725.13. The Nifty 50 index was up 33.65 points or 0.28% at 11,881.20.

The June 2019 F&O contracts expire today, 27 June 2019. Market is likely to see volatility due to F&O expiry. Traders roll over positions in the F&O segment from the near month June 2019 series to July 2019 series.

The S&P BSE Mid-Cap index was up 0.13%. The S&P BSE Small-Cap index was up 0.68%.

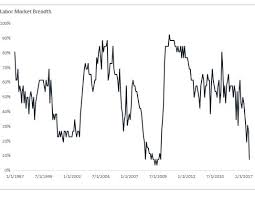

The market breadth, indicating the overall health of the market, was strong. On the BSE, 1171 shares rose and 595 shares fell. A total of 102 shares were unchanged.

Coffee Day Enterprises soared 4.46% to Rs 234 on media reports that Coca Cola could acquire a significant stake in country's largest chain Café Coffee Day.

Private sector bank stocks were trading higher. IndusInd Bank (up 1.58%), Axis Bank (up 1.15%), RBL Bank (up 0.61%), ICICI Bank (up 0.35%) and Kotak Mahindra Bank (up 0.03%) edged higher. Meanwhile, Yes Bank (down 0.57%) and HDFC Bank (down 0.06%) edged lower.

Most PSU Banks declined. Allahabad Bank (down 4.08%), Oriental Bank of Commerce (down 2.14%), Syndicate Bank (down 0.48%), Union Bank of India (down 0.39%), Bank of India (down 0.23%) and Punjab National Bank (down 0.06%) edged lower. Meanwhile, Jammu and Kashmir Bank (up 0.46%), State Bank of India (up 0.45%) and Bank of Baroda (up 0.33%) edged higher.

The S&P BSE Bankex was up 229.21 points or 0.65% at 35,237.34.

Reliance Infrastructure fell 2.71% to Rs 59.3. The company announced that CARE Ratings has moved the ratings of short term facilities from “CARE A4 - Stable to CARE D (Issuer not cooperating). Further, the rating of Non Convertible Debentures has been moved from CARE B - Stable to CARE C - Stable (Issuer not cooperating). The announcement was made after market hours yesterday, 26 June 2019.

Most pharmaceutical stocks declined. Wockhardt (down 1.94%), Dr Reddy's Laboratories (down 0.88%), Glenmark Pharmaceuticals (down 0.68%), Sun Pharmaceuticals (down 0.30%), Alkem Laboratories (down 0.28%), GlaxoSmithKline Pharmaceuticals (down 0.12%), Divi's Laboratories (down 0.9%), Aurobindo Pharma (down 0.9%) and Piramal Enterprises (down 0.01%) edged lower. IPCA Laboratories (up 1.28%), Cadila Healthcare (up 0.5%), Cipla (up 0.18%) and Lupin (up 0.08%) edged higher.

Adani Ports And Special Economic Zone was down 0.81% to Rs 411.65. The company approved the issuance of fixed rate senior unsecured notes aggregating to US$ 750 million. The company intends to use the proceeds primarily for capital expenditure, including on-lending to subsidiaries for capital expenditure purposes, and the remainder for repaying existing indebtedness as permitted under the applicable laws. The company has received Baa3 (Stable) by Moody's, BBB- (Stable) by S&P and BBB- (StabIe) by Fitch for the Notes. The notes are expected to be listed on Singapore Exchange Securities. The interest rate payable on these notes would be 4.375% per annum, payable semi-annually, commencing from 3 January 2020. The announcement was made before market hours today, 27 June 2019.

0 thoughts on “Strong market breadth”