Industry consolidation, along with increasing buyers’ preference for developers with strong brand equity, is a positive for Sobha, say analysts. Besides, sales in other cities including Chennai, Kochi, Coimbatore, Pune and Thrissur have been good, too.

However, apart from the weak 1.2% growth in home sales, the 11% drop in average realization is a damper. Analysts reckon this could be due to the growing share of lower- value affordable homes, in sales.

Lately, about half of Sobha’s sales are in the ₹1-2 crore per unit bracket. The premium ₹2 crore and above-segment has been contracting sharply, indicating weak demand. In fact, lower bank interest rates and transparency through the Real Estate (Regulation and Development) Act are yet to move the premium and luxury residential property market out of its deep slumber.

Elara Securities (India) Pvt. Ltd said: “This was another quarter where new launches were subdued. For the nine months ended December, Sobha has just launched 0.79 million square feet, as the company wants to focus on monetizing existing projects."

The company is confident of achieving stronger growth in the coming quarters through release of inventory in existing projects and about 10.5 million sq. ft of new launches. Further, Sobha’s presence in contractual business and manufacturing of interiors, concrete products, and glazing and metal works helps it diversify the risk from weak sales.

Even so, management optimism is yet to reflect in Sobha’s stock, which has underperformed the benchmark Nifty Realty index in recent months.

Apart from subdued sales and weak realizations, rising debt is another concern. As of September-end, net debt had risen 8.4% from the preceding quarter to ₹2,983 crore and debt-to-equity ratio had increased marginally to 1.3.

News of unsold inventory, too, weighs on investor sentiment. A Knight Frank report on 2019 sales said unsold inventory in the top eight cities in the country declined by 5%. Bengaluru stands third, after the National Capital Region and Mumbai Metropolitan Region, with unsold inventory of 78,414 units.

Indeed, Sobha’s strong brand equity and ability to stand tall through rough weather are encouraging. However, investors will closely monitor rising debt and sustained sales growth in the coming days.

" />

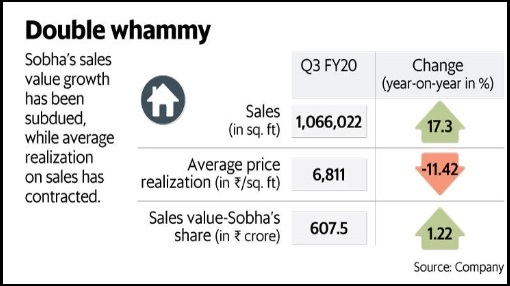

Bengaluru-based real estate developer Sobha Ltd’s overall sales volumes during Q3 FY20 rose by an impressive 17% year-on-year. Yet, this may not satisfy investors given that in value terms, the company’s sales grew by just 1.2%.

Sure, the preliminary sales numbers mirror the resilience of the Bengaluru market, which accounts for 77% of Sobha’s sales. The city clocked 33.5% sales growth for the company.

Industry consolidation, along with increasing buyers’ preference for developers with strong brand equity, is a positive for Sobha, say analysts. Besides, sales in other cities including Chennai, Kochi, Coimbatore, Pune and Thrissur have been good, too.

However, apart from the weak 1.2% growth in home sales, the 11% drop in average realization is a damper. Analysts reckon this could be due to the growing share of lower- value affordable homes, in sales.

Lately, about half of Sobha’s sales are in the ₹1-2 crore per unit bracket. The premium ₹2 crore and above-segment has been contracting sharply, indicating weak demand. In fact, lower bank interest rates and transparency through the Real Estate (Regulation and Development) Act are yet to move the premium and luxury residential property market out of its deep slumber.

Elara Securities (India) Pvt. Ltd said: “This was another quarter where new launches were subdued. For the nine months ended December, Sobha has just launched 0.79 million square feet, as the company wants to focus on monetizing existing projects."

The company is confident of achieving stronger growth in the coming quarters through release of inventory in existing projects and about 10.5 million sq. ft of new launches. Further, Sobha’s presence in contractual business and manufacturing of interiors, concrete products, and glazing and metal works helps it diversify the risk from weak sales.

Even so, management optimism is yet to reflect in Sobha’s stock, which has underperformed the benchmark Nifty Realty index in recent months.

Apart from subdued sales and weak realizations, rising debt is another concern. As of September-end, net debt had risen 8.4% from the preceding quarter to ₹2,983 crore and debt-to-equity ratio had increased marginally to 1.3.

News of unsold inventory, too, weighs on investor sentiment. A Knight Frank report on 2019 sales said unsold inventory in the top eight cities in the country declined by 5%. Bengaluru stands third, after the National Capital Region and Mumbai Metropolitan Region, with unsold inventory of 78,414 units.

Indeed, Sobha’s strong brand equity and ability to stand tall through rough weather are encouraging. However, investors will closely monitor rising debt and sustained sales growth in the coming days.

0 thoughts on “Sobhas sales up but weak realizations and rising debt are playing spoilsport”