In fact, north India continues to enjoy better cement realizations as compared to other regions. “North has been the best market in the last six months with just 2-3% price corrections, versus 7% on a pan-India basis from the peak in May 2019. Shree Cement has 2/3rd volumes in North should see lesser price pressure than peers in 3Q20E," said a recent note by Kotak Institutional Equities.

Prices of raw material, such as petcoke, and lower power costs have also aided the company’s margins. This has also resulted in better operating leverage. In Q2, Shree Cement operated at Ebitda (earnings before interest, tax, depreciation and amortization) margins of about 30.1%, which is the highest in recent times.

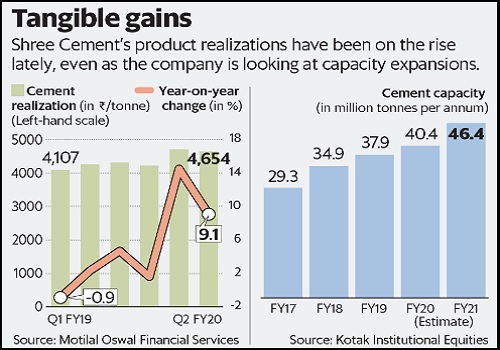

Still, the company aims to raise capacity from 40 million tonnes per annum (mtpa) to about 46.4 mpta over the next 18 months. Additionally, it is working on raising capacity to 56 mtpa in the next three years. The company has already raised equity through a placement, while the rest will be from internal accruals.

However, the rising capacities may increase margin pressure in FY21 as infrastructure growth continues to remain an overhang. Volumes have increased lately because of trade channels. A rise in raw material prices given the global uncertainty could be another challenge.

While Shree Cement’s stock has traded at a premium to some of its peers, its valuations are not much of a comfort. The stock is trading at a price-earnings multiple of 61.2 times trailing 12-month earnings. “We maintain SELL on expensive valuations; fair value unchanged at ₹15,200/share," added the Kotak report.

" />

Lower input prices and improving realizations have driven the Shree Cement Ltd stock into uncharted territory. It surged to an all-time high of ₹22,441, up about 34% in the past year.

Sluggish demand did not seem to deter investors, as realizations were firm in north India, its primary base. Lack of capacity in the region meant that Shree Cement could net about ₹4,654 per tonne in the second quarter of FY20. This was higher by about 9.1% year- on-year. Though realizations had softened marginally in Q1, the trend in pricing had remained firm.

In fact, north India continues to enjoy better cement realizations as compared to other regions. “North has been the best market in the last six months with just 2-3% price corrections, versus 7% on a pan-India basis from the peak in May 2019. Shree Cement has 2/3rd volumes in North should see lesser price pressure than peers in 3Q20E," said a recent note by Kotak Institutional Equities.

Prices of raw material, such as petcoke, and lower power costs have also aided the company’s margins. This has also resulted in better operating leverage. In Q2, Shree Cement operated at Ebitda (earnings before interest, tax, depreciation and amortization) margins of about 30.1%, which is the highest in recent times.

Still, the company aims to raise capacity from 40 million tonnes per annum (mtpa) to about 46.4 mpta over the next 18 months. Additionally, it is working on raising capacity to 56 mtpa in the next three years. The company has already raised equity through a placement, while the rest will be from internal accruals.

However, the rising capacities may increase margin pressure in FY21 as infrastructure growth continues to remain an overhang. Volumes have increased lately because of trade channels. A rise in raw material prices given the global uncertainty could be another challenge.

While Shree Cement’s stock has traded at a premium to some of its peers, its valuations are not much of a comfort. The stock is trading at a price-earnings multiple of 61.2 times trailing 12-month earnings. “We maintain SELL on expensive valuations; fair value unchanged at ₹15,200/share," added the Kotak report.

0 thoughts on “Shree Cement Slowing economy to weigh on soaring realizations”