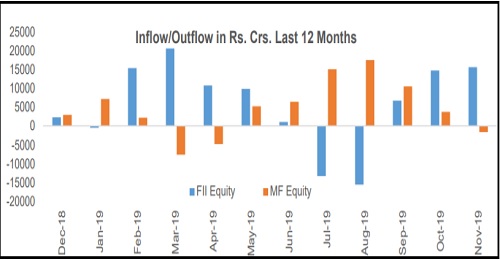

FII flows had turned negative in the first half of the calendar year 2019. Growth concerns globally as well as domestically had impacted the risk sentiments and resulted in FIIs moving out of Indian equities. The growth concerns still prevail, but with the government stepping-in to support growth, the perception of economic performance improving going ahead has improved. As indicated earlier, the roll-back of taxes on FIIs and cut in corporate tax rates have been the key positive triggers. Starting from Sep’19, FIIs have been net investors in Indian equities for three consecutive months. Cumulatively, FIIs have pumped-in more than Rs. 36K crores in the last three months.

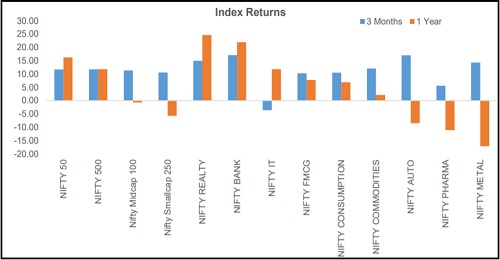

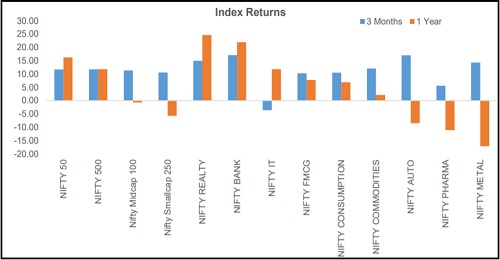

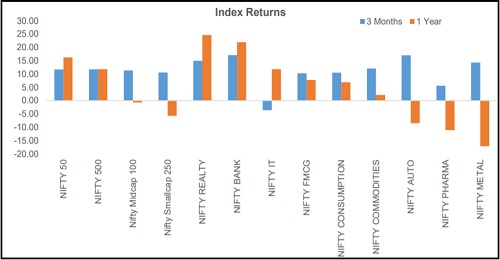

During the last one year there have been significant variations in the performance from various segments of the market. The large cap indices have delivered returns in the range of 15%, whereas the mid and small cap indices have lost value by 1% to 6%. Within large caps as well the performance is concentrated in select few stocks, which are perceived to be “good-quality-businesses”. The performance of a select small segment of the market has led to the belief that some of the “quality businesses” have become overly expensive in terms of their valuations. The overvaluation hypothesis is being putting forth to support the proposition that the probability of these businesses underperforming is high.

Growth risks, US-China trade war and BREXIT were some of the key factors that had led to a flight to safety. As these concerns started waning and government announced fiscal measures, the performance of the broader market too played catch-up. With the exception of Nifty IT Index, all the other major headline and sectoral indices have delivered healthy double digit returns over the last three months.

Quality will continue to attract inflows as growth concerns continue to linger and companies with robust balance sheets and cash flows will be able to gain market share or maintain their position. For second rung businesses to gain traction, either the economy should be expanding at a rapid pace or there should be huge inflows of liquidity seeking to buy these stocks. If we look at the current situation it is amply clear neither the economy is growing fast nor is there any huge influx of liquidity chasing stocks across the market caps. Again, quality stocks are available across market caps, and one should not be guided into looking only at large caps. Businesses which have well established and time-tested models, and leadership in profitability, market share and revenues should be looked at for investments which would be insulated from negative domestic as well as global developments.

Under these circumstances, it is imperative that we take a look at managed funds or managed portfolios, from the mutual funds space or from portfolio management services. It is important that we invest into the right stocks, but the decision becomes much easier when you commit your funds to a portfolio of stocks which has an appreciable track record. Economic growth is muted and a revival in growth, and therefore, of earnings, may be two or three quarters away. It would be a worthwhile proposition to invest in the markets in a phased manner.

" />

In the equity market analytics that we follow, the following factors are considered while taking a view of the markets. In view of the frontline indices moving up to higher levels we have revisited the three important factors to understand the main factors at work. Our observation is that factors at 1 and 3 are already supporting the markets whereas the factor at 2 is yet to indicate a potential for significant improvement before the broader markets can actually move up. A summary of the views is captured in the following paragraphs:

1.Liquidity and interest rates

The liquidity conditions in the interbank market remains in surplus and this has helped the short-term rates to remain at lower levels. The RBI has been following an accommodative policy with five straight rate cuts. With growth concerns arising from fall in GDP growth we feel that growth considerations will take precedence over price stability. There is still room for RBI to lower the base rate.

2.Earnings growth

The GDP growth for Q1 was at 5% and for Q2 is expected to be even lower than that. While there has been a pick-up in some areas it is felt that a general upward momentum in economic activity may be possible only over the next three to four quarters. The challenges to growth come in the form of lower ability of the government to spend on account of the widening fiscal deficit, the absence of any demand-centric measures to boost retail and consumption demand, and the external challenges in the form of higher oil prices, trade and tariff wars, and finally, the worsening domestic employment scenario etc.

3.Sentiment

The sentiment has improved after the cut in the corporate tax rate and the removal of high tax on FPIs. The fall in the markets which was witnessed, was mainly on account of the all-pervading negativity, which seems to be repaired as of now. The new public offerings, and the prices at which the listings have happened are all indicative of a turnaround in the sentiment.

FII flows had turned negative in the first half of the calendar year 2019. Growth concerns globally as well as domestically had impacted the risk sentiments and resulted in FIIs moving out of Indian equities. The growth concerns still prevail, but with the government stepping-in to support growth, the perception of economic performance improving going ahead has improved. As indicated earlier, the roll-back of taxes on FIIs and cut in corporate tax rates have been the key positive triggers. Starting from Sep’19, FIIs have been net investors in Indian equities for three consecutive months. Cumulatively, FIIs have pumped-in more than Rs. 36K crores in the last three months.

During the last one year there have been significant variations in the performance from various segments of the market. The large cap indices have delivered returns in the range of 15%, whereas the mid and small cap indices have lost value by 1% to 6%. Within large caps as well the performance is concentrated in select few stocks, which are perceived to be “good-quality-businesses”. The performance of a select small segment of the market has led to the belief that some of the “quality businesses” have become overly expensive in terms of their valuations. The overvaluation hypothesis is being putting forth to support the proposition that the probability of these businesses underperforming is high.

Growth risks, US-China trade war and BREXIT were some of the key factors that had led to a flight to safety. As these concerns started waning and government announced fiscal measures, the performance of the broader market too played catch-up. With the exception of Nifty IT Index, all the other major headline and sectoral indices have delivered healthy double digit returns over the last three months.

Quality will continue to attract inflows as growth concerns continue to linger and companies with robust balance sheets and cash flows will be able to gain market share or maintain their position. For second rung businesses to gain traction, either the economy should be expanding at a rapid pace or there should be huge inflows of liquidity seeking to buy these stocks. If we look at the current situation it is amply clear neither the economy is growing fast nor is there any huge influx of liquidity chasing stocks across the market caps. Again, quality stocks are available across market caps, and one should not be guided into looking only at large caps. Businesses which have well established and time-tested models, and leadership in profitability, market share and revenues should be looked at for investments which would be insulated from negative domestic as well as global developments.

Under these circumstances, it is imperative that we take a look at managed funds or managed portfolios, from the mutual funds space or from portfolio management services. It is important that we invest into the right stocks, but the decision becomes much easier when you commit your funds to a portfolio of stocks which has an appreciable track record. Economic growth is muted and a revival in growth, and therefore, of earnings, may be two or three quarters away. It would be a worthwhile proposition to invest in the markets in a phased manner.

0 thoughts on “Report on Recent Developments & Equity Markets Emkay Wealth Management”