Stocks cut losses in mid-morning trade. At 11:28 IST, the barometer index, the S&P BSE Sensex, was down 112.06 points or 0.31% at 36,434.42. The Nifty 50 index was down 53.25 points or 0.49% at 10,890.35. Pharma shares declined.

Domestic stocks drifted lower in early trade as most Asian stocks declined. Key benchmark indices extended losses and hit intraday low in morning trade.

The S&P BSE Mid-Cap index was down 1.2%. The S&P BSE Small-Cap index was down 1.4%. Both these indices underperformed the Sensex.

The market breadth, indicating the overall health of the market, was weak. On the BSE, 615 shares rose and 1512 shares fell. A total of 105 shares were unchanged.

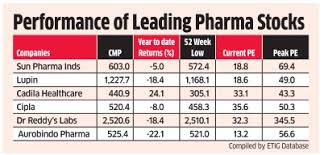

Pharma shares declined. Glenmark Pharmaceuticals (down 2.15%), Cadila Healthcare (down 0.28%), Sun Pharmaceutical Industries (down 1.88%), Alkem Laboratories (down 0.56%), GlaxoSmithKline Pharmaceuticals (down 1.01%), Aurobindo Pharma (down 1.14%) and Wockhardt (down 2.58%) edged lower. Cipla (up 1.11%) rose.

Dr Reddy's Laboratories dropped 6%. Dr Reddy's Laboratories announced that the audit of its formulations manufacturing plant - 3 at Bachupally, Hyderabad by the US Food and Drug Administration (USFDA) completed on 8 February 2019. The company has been issued a Form 483 with 11 observations. The company said it will address them comprehensively within the stipulated timeline. The announcement was made after market hours on Friday, 8 February 2019.

Lupin shed 2.1% after the company announced the completion of the United States Food and Drug Administration (USFDA) inspection at its Goa manufacturing facility. The inspection was carried out between January 28 to February 8, 2019. The inspection at the Goa facility closed with 2 observations. The observations are procedural in nature and the company is confident of addressing them satisfactorily. The announcement was made after market hours on Friday, 8 February 2019.

KRBL lost 8.01% after consolidated net profit declined 12.82% to Rs 107.22 crore on 19.45% rise in net sales to Rs 935.80 crore in Q3 December 2018 over Q3 December 2017. The result was announced after market hours on Friday, 8 February 2019.

The company said it has received a demand notice under section 153A of the Income tax Act, 1961, with respect to assessment years 2010-11 to 2016-17, amounting to Rs 757.44 crore and interest thereon (Rs 511.76 crore). The management, based on legal assessment, is confident that it has a favourable case and that the demand shall be deleted at the appellate stage. The auditors of the company have invited attention to the aforementioned issue in their review report for the period ended 31 December 2018.

Overseas, Asian stocks were mixed on Monday as concerns over global growth and US-China trade talks kept investors cautious. Markets in China and Taiwan, reopened after a weeklong Lunar New Year break. Japanese markets were closed for a holiday.

In Europe, with Brexit just 47 days away, the British government has reportedly asked lawmakers on Sunday to give Prime Minister Theresa May more time to rework her divorce deal with the European Union. Communities Secretary James Brokenshire said Parliament would get to pass judgment on May's Brexit plan no later than February 27. Britain is due to leave the EU on March 29, but Parliament has rejected May's divorce bill, leaving the prime minister to seek changes from the EU.

US stocks bounced off intraday lows to close mostly higher Friday as late afternoon buying offset pressure from lingering fears over U.S-China trade tensions.

US President Donald Trump confirmed reports that he had no plans to meet with Chinese President Xi Jinping before a March 1 trade-deal deadline. However, the US is reportedly likely to keep tariffs at 10% rather than raise them to 25% as scheduled.

0 thoughts on “Pharma shares decline”