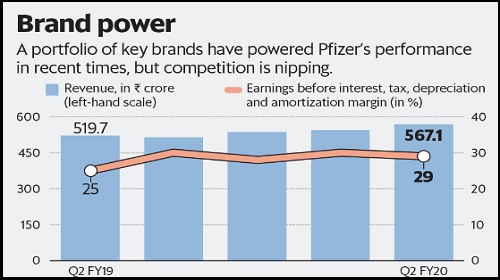

Much of its growth in recent times, though, was due to a shift in its product mix and greater productivity of its brands. In the last four years, while its revenue growth has not been much, its Ebitda (earnings before, interest, tax depreciation and amortization) has improved considerably on better pricing power. The Ebitda margin nearly doubled from about 16% in FY15 to about 29% in the first half of FY19.

Some of its specialty brands helped Pfizer command better pricing, particularly in vaccines, vitamins and cardiovascular segments.

Its vitamin brands continue to grow in double digits. Of late, prices have been rationalized further, and it is expected to aid revenue growth. “Pfizer hiked prices by about 5% and expects price, volume and launches to have equal shares in revenue growth," said B&K Securities India Pvt. Ltd in a client note.

Investors are considering the firm’s low gearing and high return ratios favourably, which are factors that helped increase its valuations in recent times. “Pfizer India is a net debt-free company with healthy core return-on-equity of 30% in FY19. Strong brand recall, consistent product launches and acquisition of brands, volume growth in top brands and intermittent price hikes provide comfort on the financial front," said ICICI Securities Ltd in a note to clients.

However, competition through the government’s Jan Aushadhi programme continues. Besides, the growing generics pie could also impact revenues. The other issue is that some of its products, such as vaccines, are priced much higher than the competition.

Nevertheless, the recent run-up in its stock price has raised the 12-month trailing earnings to around 39 times earnings per share. Many of the triggers, such as a price hike, have already been factored in the valuation. However, note that competition is getting keener. All this does not provide much of a comfort.

" />

Investors are pricing in high growth from the domestic arm of global pharmaceutical behemoth Pfizer Inc. The Pfizer Ltd stock gained nearly 36% in the last two months against the Nifty Pharma Index’s 8% gain, but may have run ahead of the market.

Some of its brands have done well in the pharma market. In the past years, the company introduced several drug formulations from its parent.

Much of its growth in recent times, though, was due to a shift in its product mix and greater productivity of its brands. In the last four years, while its revenue growth has not been much, its Ebitda (earnings before, interest, tax depreciation and amortization) has improved considerably on better pricing power. The Ebitda margin nearly doubled from about 16% in FY15 to about 29% in the first half of FY19.

Some of its specialty brands helped Pfizer command better pricing, particularly in vaccines, vitamins and cardiovascular segments.

Its vitamin brands continue to grow in double digits. Of late, prices have been rationalized further, and it is expected to aid revenue growth. “Pfizer hiked prices by about 5% and expects price, volume and launches to have equal shares in revenue growth," said B&K Securities India Pvt. Ltd in a client note.

Investors are considering the firm’s low gearing and high return ratios favourably, which are factors that helped increase its valuations in recent times. “Pfizer India is a net debt-free company with healthy core return-on-equity of 30% in FY19. Strong brand recall, consistent product launches and acquisition of brands, volume growth in top brands and intermittent price hikes provide comfort on the financial front," said ICICI Securities Ltd in a note to clients.

However, competition through the government’s Jan Aushadhi programme continues. Besides, the growing generics pie could also impact revenues. The other issue is that some of its products, such as vaccines, are priced much higher than the competition.

Nevertheless, the recent run-up in its stock price has raised the 12-month trailing earnings to around 39 times earnings per share. Many of the triggers, such as a price hike, have already been factored in the valuation. However, note that competition is getting keener. All this does not provide much of a comfort.

0 thoughts on “Pfizers brand strategy is paying off but the valuations are pricey”