But as Moody’s change of outlook implies, concerns about recovery have persisted. Sharda Cropchem Ltd, another agrochemical firm with significant presence in overseas markets, indicates tough market conditions in North America and not so encouraging signs in Europe.

The US, a large market for UPL and on which the company is pinning hopes of recovery in the second half of the fiscal year, continues to face the repercussions of adverse weather conditions of the last season.

As a consequence, inventories of agriculture inputs continue to remain high. Ergo, the scope for sales boost is limited. “Management sounded cautious for the upcoming season as NAFTA was already witnessing supply glut ensuing into no scope of further product push, while lower realizations continues to remain a drag," analysts at Antique Stock Broking Ltd said in a note after meeting the management of Sharda Cropchem. NAFTA refers to Canada, Mexico and the US, members of the North American Free Trade Agreement.

The product inventories are relatively lower in Europe. But the region is splintered between extreme dry and wet conditions, clouding outlook for grain crops.

The recovery in North America and Europe to some extent are crucial for UPL to achieve its targeted earnings guidance in FY20.

A sluggish and slow recovery can weigh on the agrochemical company’s earnings and impact its ability to reduce debt it had piled through acquisitions. Moody’s believes the credit metrics of UPL will take longer than expected to improve.

" />

Investors shrugged off the cut in outlook by Moody’s Investors Service on UPL Corp. Ltd to stable from positive, sending the stock lower by 0.5% on Tuesday. UPL Corp. is a unit of UPL Ltd through which the company acquired Arysta LifeScience Inc. for $4.2 billion.

The agency has flagged off the weaker-than-expected operating performance of the UPL Group as the reason behind the change in outlook. The holding company UPL clocked subdued performance in first half of FY20.

However, the rating has been kept unchanged on the company’s senior unsecured notes maturing in 2021.

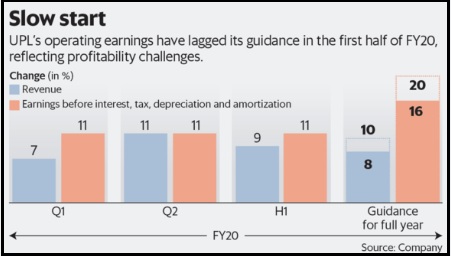

Indeed, the concerns behind the outlook change are not unfounded. The operating profit growth of 11% was way below the 16-20% growth the management projected for FY20. Granted, revenue grew 9%, in line with the 8-10% guidance UPL provided at the beginning of the fiscal year. The company has stuck to its guidance on both revenue and operating profit even after two quarters, as reiterated by the management in the conference call with analysts post September quarter earnings.

But as Moody’s change of outlook implies, concerns about recovery have persisted. Sharda Cropchem Ltd, another agrochemical firm with significant presence in overseas markets, indicates tough market conditions in North America and not so encouraging signs in Europe.

The US, a large market for UPL and on which the company is pinning hopes of recovery in the second half of the fiscal year, continues to face the repercussions of adverse weather conditions of the last season.

As a consequence, inventories of agriculture inputs continue to remain high. Ergo, the scope for sales boost is limited. “Management sounded cautious for the upcoming season as NAFTA was already witnessing supply glut ensuing into no scope of further product push, while lower realizations continues to remain a drag," analysts at Antique Stock Broking Ltd said in a note after meeting the management of Sharda Cropchem. NAFTA refers to Canada, Mexico and the US, members of the North American Free Trade Agreement.

The product inventories are relatively lower in Europe. But the region is splintered between extreme dry and wet conditions, clouding outlook for grain crops.

The recovery in North America and Europe to some extent are crucial for UPL to achieve its targeted earnings guidance in FY20.

A sluggish and slow recovery can weigh on the agrochemical company’s earnings and impact its ability to reduce debt it had piled through acquisitions. Moody’s believes the credit metrics of UPL will take longer than expected to improve.

0 thoughts on “Moodys change of outlook reinforces concerns of sluggish recovery at UPL”