The market turned range bound in mid-afternoon trade. At 14:20 IST, the barometer index, the S&P BSE Sensex, was up 262.06 points or 0.73% at 35,957.16. The Nifty 50 index was up 70 points or 0.65% at 10,797.35. The undertone of the market continued to be strong amid positive global cues. The Sensex was trading below 36,000 mark after crossing that level in morning trade. The Nifty was trading below 10,800 mark.

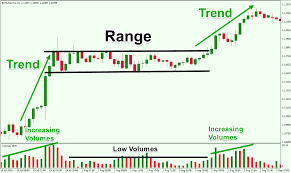

The indices opened higher and extended gains in morning trade. Indices pared gains in early afternoon trade. Benchmarks turned range bound in mid-afternoon trade.

Among secondary barometers, the BSE Mid-Cap index was up 0.29%. The BSE Small-Cap index was up 0.41%.

The market breadth, indicating the overall health of the market, was positive. On BSE, 1418 shares rose and 1046 shares fell. A total of 179 shares were unchanged.

Auto shares were mixed. Tata Motors (up 3.63%), Maruti Suzuki India (up 2.23%), Escorts (up 1.06%), Eicher Motors (up 0.60%) and Mahindra & Mahindra (up 0.17%), edged higher. TVS Motor Company (down 0.29%), Hero MotoCorp (down 0.86%), Bajaj Auto (down 2.13%) and Ashok Leyland (down 3.1%), edged lower.

Realty shares advanced. Parsvnath Developers (up 11.47%), Housing Development and Infrastructure (HDIL) (up 8.45%), D B Realty (up 6.84%), Indiabulls Real Estate (up 5.06%), Peninsula Land (up 4.91%), Godrej Properties (up 4.9%), DLF (up 4.14%), Anant Raj (up 3.02%), Prestige Estates Projects (up 0.73%), Phoenix Mills (up 0.7%), Sunteck Realty (up 0.53%), Mahindra Lifespace Developers (up 0.48%) and Omaxe (up 0.14%), edged higher. Oberoi Realty (down 0.02%) and Unitech (down 0.96%), edged lower.

Real estate developer Sobha was up 2.38%. Sobha announced that during the third quarter, it achieved new sales volume of 908,824 square feet total valued at Rs 698.80 crore with an average realisation of Rs 7,669 per square feet (Sobha share of sales value is at Rs 600.20 crore with an average realisation of Rs 6,599 per square feet). The announcement was made after market hours on Friday, 4 January 2019.

Meanwhile, the provisional figures of Direct Tax collections up to December, 2018 show that gross collections are at Rs 8.74 lakh crore which is 14.1% higher than the gross collections for the corresponding period of last year. Refunds amounting to Rs 1.30 lakh crore have been issued during April 2018 to December 2018, which is 17% higher than refunds issued during the same period in the preceding year. Net collections (after adjusting for refunds) have increased by 13.6% to Rs 7.43 lakh crore during April - December 2018. The net Direct Tax collections represent 64.7% of the total Budget Estimates of Direct Taxes for FY 2018-19 (Rs 11.50 lakh crore).

An amount of Rs 3.64 lakh crore has been collected as Advance Tax, which is 14.5% higher than the Advance Tax collections during the corresponding period of last year. The growth rate of Corporate Advance Tax is 12.5% and that of PIT Advance Tax is 23.8%.

Overseas, shares in Europe and Asia advanced on Monday as a dovish turn by the Federal Reserve and startlingly strong US jobs data soothed some of the market's worst fears about the global outlook.

Investor sentiment also picked up slightly ahead of a round of trade negotiations between the United States and China in Beijing. The US and China will hold vice ministerial level trade talks in Beijing on January 7-8, according to the Chinese commerce ministry.

US stocks surged higher on Friday, buoyed by a better-than-expected jobs report for December and dovishly interpreted remarks by the chairman of the Federal Reserve.

The Bureau of Labor Statistics said the US economy added 312,000 jobs in December. The surge in hiring was the largest since February.

Investor optimism was further reinforced by comments by Federal Reserve Chairman Jerome Powell, who said during a Friday morning appearance that the jobs report didn't materially increase concerns over rising inflation, while reiterating that the central bank would continue to keep an open mind about how much it will raise interest rates in 2019 and how aggressively it will shrink its balance sheet, based on incoming data about the US and global economy, including recent weakness in equity markets.

0 thoughts on “Market turns range bound”