Local equities logged strong gains as bargain hunting emerged after three-day slide. The barometer index, the S&P BSE Sensex, gained 361.12 points or 1.02% to settle at 35,673.25. The Nifty 50 index gained 92.55 points or 0.87% to settle at 10,693.70. Market participants are awaiting exit poll results of five state elections due after market hours today, 7 December 2018.

Domestic stocks drifted higher in early trade. Stocks extended early gains in morning and mid-morning trade. Volatility ruled the roost in early afternoon trade as the key benchmark indices regained strength soon after trimming intraday gains. Key benchmarks were trading in a narrow range with small gains in afternoon trade. Indices were trading on a firm note in mid-afternoon trade. Stocks extended gains in late trade to hit intraday high.

In broader market, the S&P BSE Mid-Cap index rose 0.23%. The S&P BSE Small-Cap index fell 0.27%.

The market breadth, indicating the overall health of the market, was negative. On the BSE, 1097 shares rose and 1472 shares fell. A total of 155 shares were unchanged.

Among the sectoral indices on BSE, the S&P BSE Bankex (up 1.66%), the S&P BSE Capital Goods index (up 0.95%) and the S&P BSE FMCG index (up 0.82%) edged higher. The S&P BSE Oil & Gas index (down 0.65%), the S&P BSE Metal index (down 0.52%) and the S&P BSE Telecom index (down 0.47%) edged lower.

Adani Ports and Special Economic Zone (up 2.71%), Bajaj Auto (up 2.23%), Infosys (up 1.92%), Asian Paints (up 1.69%) and Hero MotoCorp (up 1.64%) edged higher from the Sensex pack.

Sun Pharmaceutical Industries (down 2.09%), Yes Bank (down 1.31%), NTPC (down 0.93%), Tata Steel (down 0.62%) and Power Grid Corporation of India (down 0.44%) were the major Sensex losers.

Kotak Mahindra Bank surged 8.53% to Rs 1,282.25 in volatile trade. The stock hit high of Rs 1,345.35 and low of Rs 1,177.30 in intraday trade. Media reports suggested that Warren Buffet promoted Berkshire Hathaway is looking to buy a 10% stake in the private sector lender. As per RBI guidelines, Uday Kotak needs to dilute his stake to below 20% by December 2018. As on 30 September 2018, Uday Suresh Kotak held 29.729% stake in Kotak Mahindra Bank.

The bank clarified to the bourses during trading hours today, 7 December 2018, that it is unaware of any plans by Berkshire Hathway buying stake in the bank as stated in the story.

HCL Technologies (HCL) lost 4.98%. HCL said it will acquire select IBM software products for $1.8 billion. The transaction is expected to close by mid-2019, subject to completion of applicable regulatory reviews. The software products in scope represent a total addressable market of more than $50 billion and include Appscan for secure application development, BigFix for secure device management, Unica (on-premise) for marketing automation, Commerce (on-premise) for omni-channel eCommerce, Portal (on-premise) for digital experience, Notes & Domino for email and low-code rapid application development, and Connections for workstream collaboration. HCL and IBM have an ongoing IP Partnership for five of these products. The announcement was made after market hours yesterday, 6 December 2018.

Wipro rose 0.75%. Wipro's digital business arm, Wipro Digital, and Alfresco, a leading enterprise open source provider of process automation, content management and information governance software, announced an expanded global partnership to create, build and run open source based digital transformation programs for its clients, across the globe. The partnership will bring together Wipro's expertise in digital transformation and Alfresco's Digital Business Platform. As a part of this alliance, the two companies will launch a series of go-to market (GTM) initiatives, that includes a joint Predictive Service Automation solution using Artificial Intelligence, Machine learning and a microservices based framework, that will transform the future of asset maintenance. The announcement was made after market hours yesterday, 6 December 2018.

Coal India shed 1.62%. Coal India announced after market hours yesterday, 6 December 2018, that the President of India, acting through the Ministry of Coal, Government of India, has sold 13.73 crore equity shares, or 2.21% equity, of Coal India to Reliance Nippon Life Asset Management. This is with reference to the setting up of the central public sector enterprise exchange traded fund (CPSE ETF) comprising equity shares of central public sector enterprises (CPSE), which was launched as the CPSE ETF mutual fund scheme (Scheme) in March 2014. Post-acquisition holding of promoter is 72.92% of equity share capital of the company.

L&T gained 1.37%. L&T Construction, the construction arm of L&T, has won orders worth Rs 2547 crore. The announcement was made during market hours today, 7 December 2018.

Tata Motors rose 0.03%. Jaguar Land Rover today reported total retail sales of 48,160 vehicles in November 2018, down 8% year-on-year reflecting continuing challenging market conditions in China. Sales in China were 50.7% lower than a year ago as market conditions remain difficult with continuing consumer uncertainty following tariff changes and trade concerns. Jaguar Land Rover continues to work closely with retailers in China to respond to the present market conditions. The announcement was made during market hours today, 7 December 2018.

Shares of Rural Electrification Corporation rose 0.67% while Power Finance Corporation shed 0.5%. The Cabinet Committee on Economic Affairs has given its 'in principle' approval for strategic sale of the Government of India's existing 52.63% of total paid up equity shareholding in Rural Electrification Corporation (REC) to Power Finance Corporation (PFC) along with transfer of management control. The Cabinet Committee on Economic Affairs (CCEA) made after market hours yesterday, 6 December 2018.

The acquisition intends to achieve integration across the power chain, obtain better synergies, create economies of scale and have enhanced capability to support energy access and energy efficiency by improved capability to finance power sector. It may also allow for cheaper fund raising with increase in bargaining power for the combined entity. Both REC and PFC are Central Public Sector Enterprises under the Ministry of Power.

Zydus Wellness rose 0.98%. The company said it is planning to raise Rs 2574.99 crore through issue of shares on a preferential basis. The firm's board approved issuing equity shares of face value of Rs 10 each on a preferential basis to Cadila Healthcare, True North, Pioneer Investment Fund and Zydus Family Trust. The announcement was made after market hours yesterday, 6 December 2018.

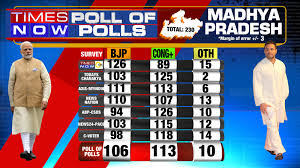

On the political front, market participants are awaiting exit poll results of five state elections due after market hours today, 7 December 2018. The outcomes of the assembly elections will likely set the tone for the general elections next year. Voting in Rajasthan and Telangana is underway today, 7 December 2018 and the counting of votes in all the states will be done on 11 December 2018. Assembly elections in Madhya Pradesh and Mizoram were held on 28 November 2018. The election in Chhattisgarh Assembly was held in two phases on 12 and 20 November 2018.

Overseas, European stocks were trading higher as technology and mining shares led the gains. Asian stocks were mixed as investors grappled with shifting indications on Sino-American trade talks and prospects for a pause in Federal Reserve tightening. Financial markets remain on edge amid worries that the trade truce between China and the US won't last after the arrest of Huawei's chief financial officer.

Market participants are awaiting US jobs data later in the session and whether it could shed any light on the health of the economy and the pace at which the Federal Reserve will raise interest rates.

US stocks closed mostly lower Thursday after a dramatic session that saw the Dow Jones Industrial Average plunge more than 700 points at one point on fears that the arrest of a Huawei executive would reignite trade worries. However, the market clawed back most of its losses on a report that the Federal Reserve may turn more accommodative.

0 thoughts on “Market rallies ahead of exit poll results”