Market is seen opening lower tracking negative leads from Asian markets and overnight slump on the Wall Street. Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could fall 46.50 points at the opening bell.

Overseas, stocks in Asia fell on the back of US stocks closing sharply lower Monday.

In US, the Dow Jones Industrial Average tumbled 600 points as crude oil prices extended their retreat while a firmer US dollar also sparked worries about the competitiveness of US corporations in an increasingly challenging economic environment.

Closer home, foreign portfolio investors (FPIs) bought shares worth a net Rs 832.15 crore on 12 November 2018, as per provisional data released by the stock exchanges. Domestic institutional investors (DIIs) sold shares worth a net Rs 1,073.84 crore on 12 November 2018, as per provisional data.

On the economic front, India's industrial production grew 4.5% in September compared with the upward revised 4.7% in August, data released by the statistics office showed. August growth had initially been estimated at 4.3%.

Inflation as measured by the Consumer Price Index stood at 3.31% in October compared to 3.70% in September, showed government data released on Monday.

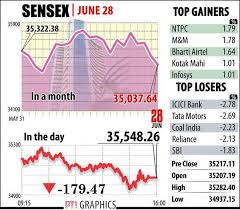

Domestic stocks logged sharp losses on Monday, 12 November 2018, on broad-based selling pressure in index pivotals. The barometer index, the S&P BSE Sensex, lost 345.56 points or 0.98% to settle at 34,812.99. The Nifty 50 index fell 103 points or 0.97% to settle at 10,482.20

0 thoughts on “Market may extend losses on weak global cues”