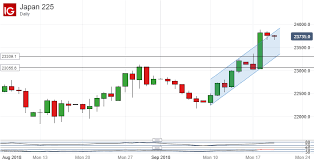

Headline indices of the Japan share market were higher on Wednesday, 28 November 2018, as investors tracking an advance in Wall Street overnight and a cheaper yen, and hope that the United States and China can work toward resolving their trade-related differences at the upcoming G20 Summit. Total 16 of TSE33 issues inclined while remaining 17 issues declined, with shares in Marine Transportation, Pharmaceutical, Information & Communication, Services, and Machinery issues being notable gainers whereas Air Transportation, Transportation Equipment, and Iron & Steel issues were notable losers. In afternoon trades, the 225-issue Nikkei index rose 195.86 points, or 0.9%, at 22,148.26. The broader Topix index of all First Section issues on the Tokyo Stock Exchange was up 4.19 points, or 0.25%, to 1,648.35.

Global developments continued to influence trading in local market today. Federal Reserve Vice Chairman Richard Clarida backed gradual rate hikes ahead of Jerome Powell's speech on Wednesday. Clarida said risks to the U.S. economy are less skewed to the downside, while St. Louis Fed President James Bullard was more cautious, telling that officials must monitor possible “cracks” in the U.S. recovery and that growth is going to slow in 2019 and 2020. The debate on the pace of monetary policy tightening in the U.S. next year has intensified this week ahead of Powell's speech that will be parsed for any hints on prospects for a pause in rate increases next year.

Japanese officials will be keeping a close eye on the G-20 summit in Argentina later this week when President Donald Trump and Chinese President Xi Jinping are expected to meet and discuss trade issues. The summit will be watched closely for how relations between both countries develop, in addition to further news surrounding Sino-US trade. China's main goal at the G20 meeting is to get the United States to refrain from raising the tariffs in January. Trump is open to a deal with China but is ready to impose more tariffs if the upcoming talks don't yield progress. Japan has close economic ties with both countries and the ongoing tariff spat threatens to dampen Japan's export sector.

In Japan, SPPI and BoJ Core CPI both edged higher, but the yen was unable to capitalize on Tuesday. Last week, National Core CPI, which excludes volatile food prices, came in at 1.0% on an annualized basis, for a second straight month. The BoJ's target of around 2% remains elusive and inflation could face further headwinds, as the slowdown in China and the ongoing global trade war takes a bite out of the country's export sector. As well, lower oil prices could also hamper inflation. There is little reason to expect that inflation will gather any upward momentum and some analysts are forecasting that inflation in 2018 will fall below the 1% level.

CURRENCY NEWS: Japanese yen depreciated in the upper-113 yen zone against greenback on Wednesday. The dollar was quoted at 113.77-78 yen compared with 113.72-82 yen in New York and 113.59-60 yen on Tuesday in Tokyo. The euro, meanwhile, fetched 128.54-58 yen against 128.49-59 yen in New York and 128.48-52 yen in Tuesday trade in Tokyo.

OFFSHORE MARKET NEWS: Wall Street stocks closed higher on Tuesday. The Dow Jones Industrial Average added 108.49 points, or 0.4%, to 24,748.73. The broad-based S&P 500 rose 8.72 points, or 0.3%, to 2,682.17, while the tech-rich Nasdaq Composite Index inched up 0.85 points to 7,082.80.

The major European markets moved to the downside on Tuesday. The German DAX Index fell by 0.4%. The U.K.'s FTSE 100 Index and the French CAC 40 Index dipped by 0.3% and 0.2%, respectively.

0 thoughts on “Japan Nikkei gains on firm offshore cues”