In its quarterly preview report, IIFL Institutional Equities said most orders were from the hydrocarbons sector (that too, one large order), while the rest came from water, civil, transportation, and transmission and distribution segments.

Meanwhile, excluding the services sectors, L&T’s order flows from its core engineering and construction (E&C) segment may drop at an even higher rate.

If the Q3 results confirm such weakness in order flows, the company may also reduce its order inflows guidance for the full year.

To meet its current 10-12% growth target, L&T would require order flows worth about ₹1 trillion in the second half. “The 10-12% guidance is unlikely to be met and, at best, it may clock flat growth, or 5% contraction in FY20," said analysts at IIFL.

This scepticism is mirrored in the L&T stock, which has not budged from its year-ago level, while the Nifty has risen by 13%.

That said, the company’s trump card is its huge order backlog that assures revenue traction for the next 24-30 months. Even in Q3 FY20, revenue for the core E&C sector is expected to clock double-digit growth. Overall, revenue is likely to grow by 15-17%, even as L&T strives to maintain operating margins of the year-ago level of 11%.

However, investor sentiment in the capital goods and infrastructure sectors is primarily driven by order flows, which provide insights into the how sustainable the company’s performance is. Hence, any downward revision in order flow guidance may be a setback for the L&T stock, masking other positives—be it revenue and margin growth, or better working capital management.

On the other hand, any positive surprises in order flows will fuel the L&T stock, given that risks have already been priced in.

" />

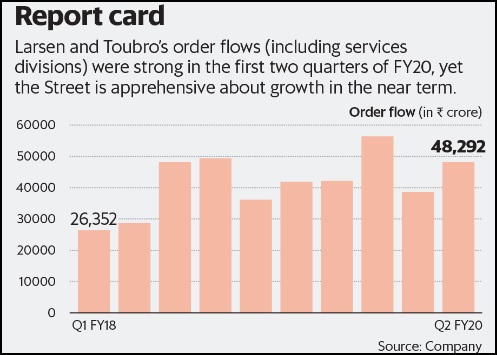

The slack in government ordering and private sector capital expenditure has turned brokerage firms cautious about the order flows to diversified conglomerate Larsen and Toubro Ltd (L&T).

Ahead of its December quarter (Q3 FY20) results announcement on Wednesday, analysts forecast a sharp 15% year-on-year drop in order flows to about ₹36,000 crore.

This in spite of a low base, with Q3 FY19 order flows contracting 12% year-on-year due to the general election.

In its quarterly preview report, IIFL Institutional Equities said most orders were from the hydrocarbons sector (that too, one large order), while the rest came from water, civil, transportation, and transmission and distribution segments.

Meanwhile, excluding the services sectors, L&T’s order flows from its core engineering and construction (E&C) segment may drop at an even higher rate.

If the Q3 results confirm such weakness in order flows, the company may also reduce its order inflows guidance for the full year.

To meet its current 10-12% growth target, L&T would require order flows worth about ₹1 trillion in the second half. “The 10-12% guidance is unlikely to be met and, at best, it may clock flat growth, or 5% contraction in FY20," said analysts at IIFL.

This scepticism is mirrored in the L&T stock, which has not budged from its year-ago level, while the Nifty has risen by 13%.

That said, the company’s trump card is its huge order backlog that assures revenue traction for the next 24-30 months. Even in Q3 FY20, revenue for the core E&C sector is expected to clock double-digit growth. Overall, revenue is likely to grow by 15-17%, even as L&T strives to maintain operating margins of the year-ago level of 11%.

However, investor sentiment in the capital goods and infrastructure sectors is primarily driven by order flows, which provide insights into the how sustainable the company’s performance is. Hence, any downward revision in order flow guidance may be a setback for the L&T stock, masking other positives—be it revenue and margin growth, or better working capital management.

On the other hand, any positive surprises in order flows will fuel the L&T stock, given that risks have already been priced in.

0 thoughts on “Investors wary of risks to order flow guidance at Larsen and Toubro”