The bad loan hush up happened during Kapoor’s time but the fact that new chief Ravneet Gill couldn’t spot it after he took charge in March is uncomfortable for investors.

But they are willing to cut Gill some slack considering that he didn’t have adequate time to unearth all misgivings of the former management. Gill had less than two months before he and the board approved financial results on 26 April. This explains why the stock didn’t react negatively to the news. In fact, it ended up 3%.

Also, the bank has since then beefed up provisions and come clean on the extent of its stressed loans.

In the first two quarters of FY20, the bank has provided a cumulative ₹3,120 crore against bad loans. It has also recognized loans worth ₹31,000 crore as stressed. A new management team is in place which should give some comfort to investors.

That said, for Gill and Yes Bank to get back the investor love they want, capital raising is key.

Impatience is increasing in the market, as so far on the capital front there has only been lip service from the bank. No deal has fructified yet between Yes Bank and investors from whom the lender claimed it has got a binding bid.

Analysts believe that unless the cheque comes to the bank, investors are unlikely to become friendly towards the stock.

To be sure, Yes Bank shares are down 64% year to date despite recent gains after the management began its jawboning on capital. The lender’s Common Equity Tier-1 capital ratio was 8.7% as of September. But it also has a fast decaying loan book that requires accelerated provisioning. It bears to repeat that Yes Bank needs capital to not only survive but also to grow.

" />

Yes Bank Ltd investors should be used to bad news and false hopes by now. The promise of more capital is yet to be fulfilled and skeletons from the past are still tumbling out of the cupboard.

The latest scare is the bad loans that the lender under-reported in FY19.

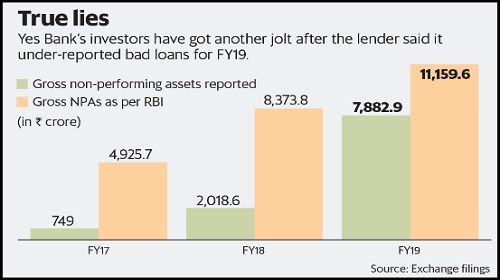

The bank in an exchange filing on Tuesday said that it under-reported gross bad loans by more than ₹3,000 crore and that the regulator assessed its bad loan addition at ₹11,159 crore for the year.

This is the third fiscal year that Yes Bank has had a large divergence with the regulator in tagging loans as bad. As the adjoining chart shows, the extent of divergence has only increased.

The divergence also came to light on a day promoters sold stake in the lender. Promoter Rana Kapoor, who was ousted as the managing director of the lender, has almost exited the bank with stake sales and now holds just a handful of Yes Bank shares.

The bad loan hush up happened during Kapoor’s time but the fact that new chief Ravneet Gill couldn’t spot it after he took charge in March is uncomfortable for investors.

But they are willing to cut Gill some slack considering that he didn’t have adequate time to unearth all misgivings of the former management. Gill had less than two months before he and the board approved financial results on 26 April. This explains why the stock didn’t react negatively to the news. In fact, it ended up 3%.

Also, the bank has since then beefed up provisions and come clean on the extent of its stressed loans.

In the first two quarters of FY20, the bank has provided a cumulative ₹3,120 crore against bad loans. It has also recognized loans worth ₹31,000 crore as stressed. A new management team is in place which should give some comfort to investors.

That said, for Gill and Yes Bank to get back the investor love they want, capital raising is key.

Impatience is increasing in the market, as so far on the capital front there has only been lip service from the bank. No deal has fructified yet between Yes Bank and investors from whom the lender claimed it has got a binding bid.

Analysts believe that unless the cheque comes to the bank, investors are unlikely to become friendly towards the stock.

To be sure, Yes Bank shares are down 64% year to date despite recent gains after the management began its jawboning on capital. The lender’s Common Equity Tier-1 capital ratio was 8.7% as of September. But it also has a fast decaying loan book that requires accelerated provisioning. It bears to repeat that Yes Bank needs capital to not only survive but also to grow.

0 thoughts on “Investors ignore Yes Banks blast from the past on hope of capital infusion”