The latest guidance cut comes in the wake of the Directorate General of Civil Aviation directive, which said that for every A320neo aircraft with modified engines added, an A320neo with unmodified engines is to be grounded.

In the presentation, IndiGo also said that it expects profit before tax (PBT) for Q3 FY20 to be flat compared to Q3 FY19, when PBT was ₹191 crore. This is hardly impressive considering the December quarter is seasonally strong.

IndiGo has considered 4-5% year-on-year growth in revenue per available seat km (RASK) and cost per available seat km (CASK) for the December quarter. RASK and CASK are unit measurements of revenue and costs, respectively.

“This would result in sharp earnings cut from our previous estimates," said analysts at Centrum Broking Ltd in a report on 5 December. “We expect earnings cut of 72.8%/ 14.1% in FY20E/21E, respectively led by moderation in ASKM growth guidance and higher costs." ASKM is available seat km, and is a measure of capacity for airlines.

To be sure, some analysts think the airline may do better than its guidance for Q3 FY20.

While that remains to be seen, fares remain a key monitorable where unfortunately, much fanfare is not happening.

“Air fares have witnessed significant year-on-year decline since October 2019," said analysts at JM Financial Institutional Securities Ltd.

“As per JM maintained air fare trends for four key routes (avg. 2 week forward daily fares), average fares for IndiGo/ SpiceJet have significantly declined by (13%/21% year-on-year) in November 2019. This will lead to moderation in yields going forward adversely impacting the earnings in a seasonally strong quarter," added the broker in a report on 6 December.

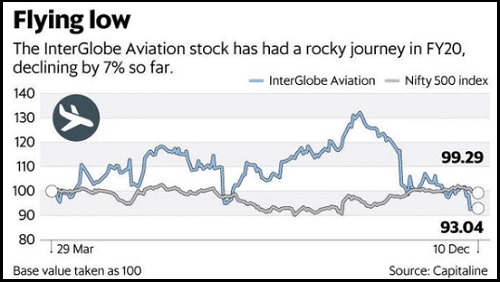

Meanwhile, the nearly 30% fall in the InterGlobe Aviation stock from its annual closing high of ₹1,890 on 30 September, suggests investors are factoring in the pessimism adequately. During this time, IndiGo announced weak September quarter results, reporting a loss of more than ₹1,000 crore.

While the downsides in the stock may be limited hereon, a take-off would require meaningful improvement in the pricing environment.

" />

Shares of InterGlobe Aviation Ltd have declined more than 5% since the airline moderated its capacity growth guidance for FY20 last week. InterGlobe runs IndiGo, India’s largest airline by market share.

According to a presentation on 4 December, IndiGo now expects its capacity to increase by 15-20% year-on-year in Q4 FY20 and 22-23% for FY20. Note that at the time of announcing its September quarter results, the firm had already cut FY20 capacity guidance to 25% from 30% earlier.

Needless to say, this will affect revenue forecast for the year.

The latest guidance cut comes in the wake of the Directorate General of Civil Aviation directive, which said that for every A320neo aircraft with modified engines added, an A320neo with unmodified engines is to be grounded.

In the presentation, IndiGo also said that it expects profit before tax (PBT) for Q3 FY20 to be flat compared to Q3 FY19, when PBT was ₹191 crore. This is hardly impressive considering the December quarter is seasonally strong.

IndiGo has considered 4-5% year-on-year growth in revenue per available seat km (RASK) and cost per available seat km (CASK) for the December quarter. RASK and CASK are unit measurements of revenue and costs, respectively.

“This would result in sharp earnings cut from our previous estimates," said analysts at Centrum Broking Ltd in a report on 5 December. “We expect earnings cut of 72.8%/ 14.1% in FY20E/21E, respectively led by moderation in ASKM growth guidance and higher costs." ASKM is available seat km, and is a measure of capacity for airlines.

To be sure, some analysts think the airline may do better than its guidance for Q3 FY20.

While that remains to be seen, fares remain a key monitorable where unfortunately, much fanfare is not happening.

“Air fares have witnessed significant year-on-year decline since October 2019," said analysts at JM Financial Institutional Securities Ltd.

“As per JM maintained air fare trends for four key routes (avg. 2 week forward daily fares), average fares for IndiGo/ SpiceJet have significantly declined by (13%/21% year-on-year) in November 2019. This will lead to moderation in yields going forward adversely impacting the earnings in a seasonally strong quarter," added the broker in a report on 6 December.

Meanwhile, the nearly 30% fall in the InterGlobe Aviation stock from its annual closing high of ₹1,890 on 30 September, suggests investors are factoring in the pessimism adequately. During this time, IndiGo announced weak September quarter results, reporting a loss of more than ₹1,000 crore.

While the downsides in the stock may be limited hereon, a take-off would require meaningful improvement in the pricing environment.

0 thoughts on “InterGlobes stock faces turbulence with check on capacity additions”