Stocks trimmed gains in morning trade after opening on a firm note. At 10:24 IST, the barometer index, the S&P BSE Sensex, was up 90.06 points or 0.25% at 35,547.22. The Nifty 50 index was up 20.75 points or 0.19% at 10,702.95.

Stocks drifted higher in early trade on buying demand in index pivotals.

The S&P BSE Mid-Cap index was up 0.21%. The S&P BSE Small-Cap index was up 0.22%.

The market breadth, indicating the overall health of the market, was positive. On the BSE, 1081 shares rose and 895 shares fell. A total of 108 shares were unchanged.

Overseas, most Asian stocks were trading higher even as investors remained cautious of tensions between the US and China after a pan-Pacific summit ended without consensus on trade issues. On the data front, Japan's monthly balance of trade tumbled to a deficit of 449 billion yen ($3.95 billion) in October amid elevated trade tensions and ramped up pressure to cut its trade surplus with the US, data from the country's finance ministry showed Monday.

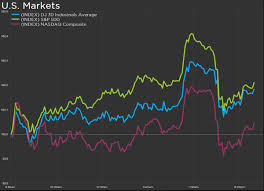

US stocks closed mostly higher on Friday, 16 November 2018 after comments from President Donald Trump once again sparked hopes that a trade dispute with China could be resolved in the near term. But the Nasdaq bucked the trend to finish lower as a decline in chip maker shares, led by Nvidia Corp., dented sentiment in the technology sector.

Industrial production rose just 0.1% in October, the Federal Reserve reported Friday. Compared to 12 months earlier, industrial production rose 4.1%.

In Europe, investors were closely watching developments in the UK, with Prime Minister Theresa May defiantly pledging her commitment to seeing Britain's exit from the European Union, despite several top-level resignations and growing doubts about her leadership.

Back home, Yes Bank (up 4.97%), Vedanta (up 1.55%), Sun Pharmaceutical Industries (up 1.2%), Tata Motors (up 1.14%) and Reliance Industries (up 1.05%) edged higher from the Sensex pack.

Bharti Airtel (down 1.89%), ICICI Bank (down 1.06%) and Wipro (down 1.03%) edged lower from the Sensex pack.

Tata Investment Corporation jumped 5.34% to Rs 867 after the company announced that its board approved a proposal to buyback upto 45 lakh equity shares of the company for an aggregate amount not exceeding Rs 450 crore, being 8.17% of the total paid-up equity share capital, at Rs 1,000 per share. The announcement was made after market hours on Friday, 16 November 2018.

SRF rose 0.48%. SRF announced that the unit in Viralimalai, Tamil Nadu of the technical textiles business (engaged in manufacture of belting fabrics) of the company has been damaged by Cyclone Gaja. The company said it has adequate insurance cover for the said unit. Adequate steps are being taken to restore normalcy and further updates in this regard will be communicated in due course. The announcement was made after market hours on Friday, 16 November 2018.

0 thoughts on “Indices trim gains”