v

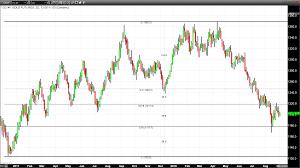

Weakness persisted on the bourses in afternoon trade on sustained selling pressure in index pivotals. At 13:30 IST, the barometer index, the S&P BSE Sensex, was down 457.15 points or 1.3% at 34,712.01. The Nifty 50 index was down 173.85 points or 1.64% at 10,425.40. Negative global stocks weighed on the sentiment.

Investors are closely awaiting the outcome of Reserve Bank of India (RBI)'s three-day Monetary Policy Committee (MPC) meeting today, 5 October 2018. The resolution of the MPC will be unveiled at 14:30 IST today, 5 October 2018.

Volatility ruled the roost in early trade as the key benchmark indices cut initial losses triggered by negative Asian stocks. The Sensex regained the psychological 35,000 level soon after sliding below that level in early trade. Fresh selling pulled the key benchmark indices lower in morning trade with the Sensex once again sliding below the 35,000 level. Stocks staged mild recovery in mid-morning trade after seeing steep intraday slide. Selling frenzy in index pivotals accentuated in early afternoon trade.

The trading activity on that day showed that the foreign portfolio investors (FPIs) sold shares worth a net Rs 2760.63 crore yesterday, 4 October 2018, as per provisional data released by the stock exchanges. Domestic institutional investors (DIIs) bought shares worth a net Rs 1823.59 crore yesterday, 4 October 2018, as per provisional data.

The S&P BSE Mid-Cap index was down 1.5%. The S&P BSE Small-Cap index was down 1.23%.

The market breadth, indicating the overall health of the market, was weak. On the BSE, 821 shares rose and 1681 shares fell. A total of 123 shares were unchanged.

IndusInd Bank (up 1.57%), Infosys (up 1.16%) and Sun Pharmaceutical Industries (up 0.73%) edged higher from the Sensex pack.

ONGC (down 15.33%), M&M (down 4.56%), Reliance Industries (down 3.71%), Coal India (down 3.62%), and Bajaj Auto (down 3.55%) edged lower from the Sensex pack.

Overseas, European stock markets declined as rising yields continued to take their toll while investors waited for a US job data report to shed some light on whether higher interest rate will be required to prevent the economy from overheating.

Asian shares dropped after benchmark US Treasury yields surged to a seven-year high and strong economic data fanned concerns about inflation and the risk of faster-than-expected interest rate rises. US stocks dropped yesterday, 4 October 2018 as as US Treasury yields continued their ascent to multi-year highs on the latest round of strong economic data, building concerns for an acceleration of inflation.

Investors will keep a close eye on monthly US payrolls report due later in the global day after the sell-off in bonds that's been in part triggered by data underscoring the strength of the American economy. Investors are looking for signs of wage growth that could accelerate Fed tightening plans in the US government's September jobs report.

0 thoughts on “Indices trading weak”