Key indices reversed early gains and traded marginally lower in morning trade. The Nifty was trading below 11,850 mark. At 10:28 IST, the barometer index, the S&P BSE Sensex, was down 21.12 points or 0.05% at 39,565.29. Nifty The Nifty 50 index was down 0.65 points or 0.01% at 11,840.90.

In broader market, the S&P BSE Mid-Cap index was down 0.10%. The S&P BSE Small-Cap index was up 0.04%.

The market breadth, indicating the overall health of the market, was positive. On the BSE, 907 shares rose and 842 shares fell. A total of 93 shares were unchanged.

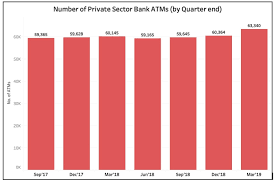

Private sector bank stocks witnessed selling. Yes Bank (down 1.07%), IndusInd Bank (down 1%), ICICI Bank (down 0.74%), RBL Bank (down 0.66%), HDFC Bank (down 0.31%), Kotak Mahindra Bank (down 0.23%) and Axis Bank (down 0.22%) declined.

Most PSU Banks advanced. Union Bank of India (up 4.51%), Bank of India (up 3.22%), Oriental Bank of Commerce (up 2.4%), Syndicate Bank (up 1.95%), Punjab National Bank (up 1.92%), Bank of Baroda (up 1.11%) and State Bank of India (up 0.15%) edged higher. Jammu and Kashmir Bank (down 2.22%) and Allahabad Bank (down 0.7%) edged lower

The S&P BSE Bankex was down 115.14 or 0.33% at 35,064.41

Glenmark Pharmaceuticals rose 0.30% to Rs 449.70. Glenmark Pharmaceuticals Inc., USA was granted the final approval by the USFDA for manufacturing Ezetimibe and Simvastatin tablets, a generic version of Vytorin tablets of MSD International GmbH.

Excel Industries was up 2.86% to Rs 963.95. The company approved the acquisition of a chemical manufacturing unit of NetMatrix Crop Care. The acquisition will help the company in adding manufacturing facility for capacity expansion along with expansion in product range. The cost of acquisition is Rs 95 crore.

Meanwhile, the Government of India has decided to constitute a Working Group for the revision of the current series of Wholesale Price Index (Base 2011-12). The Working Group is tasked with selecting the most appropriate Base Year for the preparation of a new official series of Index Numbers of Wholesale Price (WPI) and Producer Price Index (PPI) in India. The Working Group is expected to review the existing system of price collection in particular for manufacturing sector and suggest changes for improvement. It will also decide on the computational methodology to be adopted for monthly WPI/PPI and will examine the existing methodology of compilation of PPI approved by Technical Advisory Committee on Series of Prices and Cost of Living and suggest further improvement in compilation and presentation.

Meanwhile, the markets regulator Securities and Exchange Board of India (Sebi) on Thursday tightened the disclosure around pledged shares. The regulator has said any promoter whose pledging exceeds 20% of the shareholding or 50% of the promoter shareholding will have to cite reasons for pledging shares. Further, the regulator has expanded the definition of pledged shares to ensure all forms of encumbrance are covered.

Overseas, Asian stocks were trading lower on Friday as investors watched for developments from the G-20 summit in Osaka, Japan.

In US, the S&P 500 halted a four-day slump but the Dow marked its longest skid since March as investors awaited U.S.-China trade talks between President Donald Trump and China's President Xi Jinping during the G-20 meeting in Japan that begins Friday. A tariff cease-fire between Beijing and Washington would avert the next round of tariffs on additional $300 billion worth of Chinese imports.

On the economic data front, the Commerce Department issued its final revision of first quarter GDP growth and said the U.S. economy grew at a solid rate of 3.1% in the first quarter, but consumer spending and business investments grew at a slower pace than in the earlier estimates. The economy grew at a 2.2% pace in the October-December period.

0 thoughts on “Indices reverse early gains private banks decline”