Domestic stocks snapped three-day losses to score strong gains on positive global stocks. A sharp decline in crude oil prices also boosted gains. Today's rally was led by HDFC Bank, Hindustan Unilever and ITC. The Sensex ended above the psychological 35,000 mark after gyrating above and below that level in intraday trade.

The barometer index, the S&P BSE Sensex, rose 373.06 points or 1.07% to settle at 35,354.08. The index hit high of 35,397.24 and low 34,896.07 during the day.

The Nifty 50 index rose 101.85 points or 0.97% to settle at 10,628.60. The index hit high of 10,637.80 and low 10,489.75 during the day.

Among secondary barometers, the BSE Mid-Cap index rose 0.06%. The BSE Small-Cap index fell 0.15%. Both these indices underperformed the Sensex.

The market breadth, indicating the overall health of the market, was negative. On BSE, 1063 shares rose and 1522 shares fell. A total of 196 shares were unchanged.

Among the sectoral indices on BSE, the S&P BSE FMCG index (up 2.2%), the S&P BSE Bankex (up 1.27%), the S&P BSE Auto index (up 1.1%) outperformed the Sensex. The S&P BSE Metal index (down 1.33%), the S&P BSE Healthcare index (down 0.87%), the S&P BSE Oil & Gas index (down 0.22%) underperformed the Sensex.

Hero MotoCorp (up 5.02%), Asian Paints (up 2.72%), Axis Bank (up 2.69%), IndusInd Bank (up 2.3%), Bajaj Auto (up 2.23%) and ITC (up 1.85%) were the major Sensex gainers.

Yes Bank (down 3.89%), ONGC (down 3.58%), Sun Pharmaceutical Industries (down 2.88%), Coal India (down 1.85%) and Tata Steel (down 1.64%) were the major Sensex losers.

Bharti Airtel gained 1.84%. Airtel Africa, a subsidiary of Bharti Airtel, today announced the appointment of global banks for an intended IPO on an international stock exchange. This follows the recent subscription of shares in Airtel Africa by six leading global investors for an aggregate consideration of $1.25 billion. The announcement was made before market hours today, 26 November 2018.

Airtel Africa is a pan-African telecommunications company with operations in 14 countries across Africa. Its product offerings include 2G, 3G and 4G wireless voice and data services and mobile commerce through Airtel Money.

As reported in the October 2018 quarterly report, during the second quarter ending 30 September 2018, Airtel Africa's revenues grew in constant currency by 10.8% Y-o-Y, led by growth in data and Airtel money transactions. The company also witnessed an improvement of EBITDA margin by 3.9% Y-o-Y to 37.1%.

HCL Technologies (up 1.88%) and Bajaj Finance (up 0.61%) rose. Wipro (up 3.76%) and Adani Ports and Special Economic Zone (up 0.54%) gained. HCL Technologies and Bajaj Finance will be included in the S&P BSE Sensex while Wipro and Adani Ports and Special Economic Zone will be excluded from the S&P BSE Sensex from 24 December 2018. The announcement was made after market hours on Thursday, 22 November 2018.

FMCG shares rose. Hindustan Unilever (up 4.21%), GlaxoSmithKline Consumer Healthcare (up 1.29%), Dabur India (up 4.69%), Colgate Palmolive (India) (up 4.13%), Nestle India (up 1.13%), Godrej Consumer Products (up 4.35%), Jyothy Laboratories (up 4.92%), Procter & Gamble Hygiene & Health Care (up 1.23%), Marico (up 1.74%), Bajaj Corp (up 0.14%) and Tata Global Beverages (up 086%) and Britannia Industries (up 0.25%) edged higher.

Most metal shares declined. Jindal Steel & Power (down 5.16%), Steel Authority of India (down 3.89%), Vedanta (down 1.9%), Hindustan Copper (down 1.5%), Tata Steel (down 1.64%) and JSW Steel (down 0.52%) fell. National Aluminium Company (up 0.15%), NMDC (up 0.94%), Hindalco Industries (up 0.48%) and Hindustan Zinc (up 0.04%) rose.

Drug major Lupin fell 0.71%. The company announced during trading hours today, 26 November 2018, that it has received approval from the United States Food and Drug Administration (USFDA) to market a generic version of SpecGx LLC's Anafranil Capsules, 25 mg, 50 mg, and 75 mg. Lupin's Clomipramine Hydrochloride Capsules USP, 25 mg, 50 mg, and 75 mg is indicated for the treatment of obsessions and compulsions in patients with Obsessive-Compulsive Disorder (OCD). Anafranil Capsules had annual sales of approximately $109.6 million in the US (IQVIA MAT September 2018).

In a separate announcement, Lupin said that it received approval from USFDA to market a generic version of Pharma Research Software Solution LLC's Potassium Chloride for Oral Solution, 20 mEq. Lupin's Potassium Chloride for Oral Solution USP, 20 mEq is indicated for the treatment and prophylaxis of hypokalemia with or without metabolic alkalosis, in patients for whom dietary management with potassium-rich foods or diuretic dose reduction is insufficient. Potassium Chloride for Oral Solution USP, 20 mEq had annual sales of approximately $105 million in the US (IQVIA MAT September 2018).

BEML rose 1.98%. The company has been awarded the Letter of Acceptance from DMRC for supply of 378 metro coaches (63 metro trains) to Mumbai Metro Line - 2 & 7 project. The contract is worth about Rs 3015 crore and the scope of work include design, manufacture, supply, testing & commissioning of 378 metro coaches, supply of spares and training of personnel. As per the contractual timelines, train deliveries are scheduled to commence from July 2020 until September 2022. The announcement was made on Friday, 23 November 2018 when the stock markets were closed for local holiday.

Cochin Shipyard rose 2.51% to Rs 386.60 after the company announced buyback of up to 43.95 lakh shares at Rs 455 per share for a maximum amount of Rs 200 crore through the tender offer process. The buyback opens on 28 November 2018 and closes on 11 December 2018. The announcement was made on Friday, 23 November 2018 when the stock markets were closed for local holiday.

Oriental Bank of Commerce rose 1.32%. The bank informed that pursuant to the Government of India's PSB Reforms Agenda, the bank intends to divest its stake in its joint venture i.e. Canara HSBC Oriental Bank of Commerce Life Insurance Company (CHOIce) at an appropriate time, depending on the market conditions and available options. The announcement was made after market hours on Thursday, 22 November 2018.

Crude oil prices slumped to 2018 lows on Friday, pulled down by an emerging crude supply overhang. In the global commodities markets, Brent for January 2019 settlement was up $1.04 a barrel at $59.84 a barrel. The contract fell $4.68 a barrel or 7.37% to settle at $58.80 a barrel during the previous trading session.

India imports majority of its crude requirements and a decline in crude eases concerns on fiscal deficit, inflation and gives more room for the government to boost growth through spending on infrastructure.

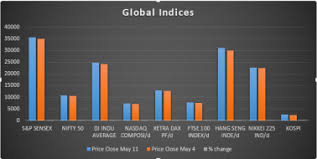

Overseas, European stocks posted solid gains on Monday, as investors digested fresh developments surrounding the UK's withdrawal process from the European Union. Investors also keyed in on developments in European politics, after the UK and European Union both announced progress on Thursday in outlining their future relationship after Britain exits the EU.

Asian indices ended higher. Trading sentiment was cautious as plunging oil prices fanned worries about a dimming outlook for the global economy.

Investors are looking ahead to a G-20 summit set to take place in Argentina later this week, where President Donald Trump and President Xi Jinping are due to meet. The summit will be watched closely for how relations between both countries develop, in addition to further news surrounding trade.

US stocks closed lower Friday, pressured again by falling oil prices, which drove the indices to the second straight week of declines.

On the US data front, the Markit flash reading on manufacturing PMI fell to 55.4 in November, a three-month low.

0 thoughts on “Indices rally on positive global stocks”