Headline shares of the Hong Kong financial market declined on Thursday, 20 December 2018, tracking losses on Wall Street overnight as investor consternation was sparked after the U.S. Federal Reserve opted to hike its interest rates with two or more hikes expected for next year. In afternoon trade, the Hang Seng Index declined 291.07 points or 1.13% to 25,574.32. The Hang Seng China Enterprises Index fell 126.18 points or 1.24% to 10,069.41.

US share market closed down on Wednesday, as the Federal Reserve lifted interest rates as expected, even as the central bank signalled it expects slower rate increases next year. While the Fed also forecast fewer than previously estimated rate hikes next year, the central bank's tone was not as dovish as some traders had hoped. The Dow tumbled 351.98 points or 1.5% to 23,323.66, the Nasdaq plummeted 147.08 points or 2.2% to 6,636.83 and the S&P 500 slumped 39.20 points or 1.5% to 2,506.96.

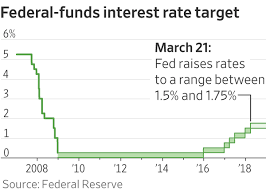

The US central bank took the target range for its benchmark funds rate to 2.25% to 2.5%. The move marked the fourth increase this year and the ninth since it began normalizing rates in December 2015. But two hikes are now projected for next year, which is a reduction but still ahead of current market pricing of no additional moves next year. The language in the post-meeting statement was not entirely dovish, or easy on its outlook for rates. The committee continued to include a statement that more rate hikes would be appropriate, though it did soften the tone a bit. Equities and oil prices reacted poorly to the Fed forward guidance which suggests that the central bank remains on “auto pilot.

China's central bank announced stimulus measures that include a new lending facility to encourage lending to small businesses. Chinese state media reported that large commercial banks, joint-stock banks and commercial banks in major cities which demonstrate support for the real economy will be allowed to apply for the targeted medium-term lending facility. China's yuan weakened past the 6.91-to-the-dollar level and was last trading at 6.9136 per dollar, 0.3% weaker than the previous day's late session close.

0 thoughts on “Hong Kong Stocks retreat on Fed rate signals”