The Mainland China equity market declined on Monday, 08 July 2019, as investors were drawing their money from the main board to the new tech board. Meanwhile, selloff pressure intensified amid uncertainty over the outlook for Sino-U.S. trade, monetary policy and after solid US non-farm payrolls print dampened market expectations the Federal Reserve would cut rates more than twice this year. At closing bell, the benchmark Shanghai Composite Index retreated 2.58%, or 77.70 points, to 2,933.36. The Shenzhen Composite Index, which tracks stocks on China's second exchange, dropped 2.9%, or 46.40 points, to 1,554.80. The blue-chip CSI300 index shed 2.32%, or 90.41 points, to 3,802.79.

Investors are willing to cash out and suffer a 1% to 2% drop in blue chip A-shares to potentially earn 100% to 200% in the new tech board listings. The new Nasdaq-like STAR board in Shanghai, where shares of some 25 technology companies are expected to begin trading on 22 July 2019

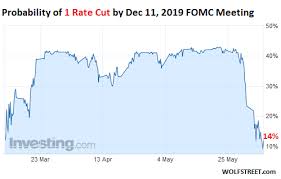

The U.S. jobs report showed the economy stateside added better than expected 224,000 jobs in June, following a dismal jobs print in May. The solid US payrolls report dampened Fed rate cut expectations and severely dented the argument for a 50bps rate cut by the end of the month.

Investors are now awaiting Fed Chairman Jerome Powell's semiannual testimony to the U.S. Congress on Wednesday and Thursday for more cues on possible rate cuts by the end of July. It is probable that the Fed will now cut rates by 0.25 percentage point instead of the aggressive market anticipation for a 0.5 percentage point cut in July.

Before the Fed's end-July policy review, some China watchers will also shift their focus to a meeting of the Politburo - a top decision-making body of China's ruling Communist Party - where the current economic situation will be discussed.

CURRENCY NEWS: China yuan declined against greenback on Monday. Prior to market opening, the People's Bank of China (PBOC) set the midpoint rate at 6.8881 per dollar, the weakest since June 19, and 184 bps, or 0.27 percent, softer than the previous fix of 6.8697. The onshore spot rate was changing hands at 6.8910, 30 bps firmer than the previous late session close.

0 thoughts on “China Market tumbles on doubts over US rate cuts Sino U S trade”