Key equity benchmarks were trading with small gains in mid-afternoon trade. At 14:20 IST, the barometer index, the S&P BSE Sensex, was up 77.18 points or 0.20% at 38,440.65. The Nifty 50 index was up 5.10 points or 0.04% at 11,537.50.

Trading kicked off on a negative note. Shares, however, gained vigor in morning trade amid broad based buying support. Indices pared gains in mid-morning trade as profit booking emerged at higher levels. Benchmarks hovered near flat line in afternoon trade. Gains were capped as investors adopted a cautious stance prior to the Federal Reserve's policy decision and further news on US-China trade talks.

Among secondary barometers, the BSE Mid-Cap index was down 0.33%. The BSE Small-Cap index was down 0.24%.

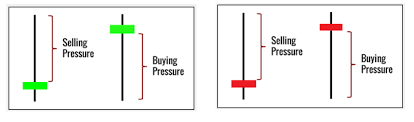

The market breadth, indicating the overall health of the market, was weak. On BSE, 1050 shares rose and 1518 shares fell. A total of 171 shares were unchanged.

Most banks shares declined. Among the private sector banks, RBL Bank (down 1.41%), ICICI Bank (down 1.07%), Federal Bank (down 1.01%), Kotak Mahindra Bank (down 0.86%), IndusInd Bank (down 0.85%), Axis Bank (down 0.51%) and City Union Bank (down 0.39%), edged lower. HDFC Bank (up 0.92%) and Yes Bank (up 1%), edged higher.

Among public sector banks, Allahabad Bank (down 1.79%), Punjab & Sind Bank (down 0.97%), Indian Bank (down 0.86%), UCO Bank (down 0.8%), Central Bank of India (down 0.72%), Bank of India (down 0.7%), Corporation Bank (down 0.69%), Andhra Bank (down 0.57%), IDBI Bank (down 0.46%), United Bank of India (down 0.36%), Punjab National Bank (down 0.33%), Canara Bank (down 0.13%) and Syndicate Bank (down 0.13%), edged lower. Union Bank of India (up 0.17%), Bank of Baroda (up 0.60%) and Bank of Maharashtra (up 0.67%), edged higher.

Power sector stocks tumbled. NTPC (down 3.81%), Adani Power (down 3%), Reliance Power (down 2.5%), GMR Infrastructure (down 1.72%), NHPC (down 1.57%), CESC (down 1.48%), JSW Energy (down 1.47%), Tata Power (down 0.68%), Jaiprakash Power Ventures (down 0.51%) and Torrent Power (down 0.32%), edged lower. Reliance Infrastructure was up 0.58%.

State-run Power Grid Corporation of India was down 0.3%. State-run Coal India was down 2.57%.

Jet Airways (India) lost 4.78% after the company said that an additional six aircraft (include one aircraft of Jet Lite (India)) have been grounded due to non-payment of amounts outstanding to lessors under their respective lease agreements. The company is actively engaged with all its aircraft lessors and regularly provides with updates on the efforts undertaken by the company to improve its liquidity. Aircraft lessors have been supportive of the company's efforts in this regard. The company is also making all efforts to minimize disruption to its network and is proactively informing and re-accommodating its affected guests. The company also continues to provide required and periodic updates to the Directorate General of Civil Aviation in this regard. The announcement was made after market hours yesterday, 19 March 2019.

Newgen Software Technologies surged 10.18% after the company announced the issuance of Patent, entitled Integrated and Automatic Generation of Carbon Credits. Newgen's platforms enable organizations to save operational costs by replacing paper and file movement with digital workflows and document management. Newgen's invention is a carbon credit analyzer coupled with the process management unit, which helps organizations automatically estimate costs & savings associated with the processing of documents. These savings are then converted to equivalent carbon credits. The patent is valid till 10 June 2029. Newgen has filed for 44 patents till date, out of which 11 have been granted. And, there are 3 patents under examination in the US. The announcement was made after market hours yesterday, 19 March 2019.

Overseas, most European and Asian shares were trading lower as investors awaited a policy decision by the US Federal Reserve.

US stock benchmarks on Tuesday closed mostly lower in a volatile session, as investors digested news on trade and awaited a policy decision by the rate-setting Federal Open Market Committee due Wednesday. Investors will focus on the statement issued by policy makers.

Global market focus is largely attuned to global trade developments, amid media reports of US concerns that China is pushing back against American demands in trade talks.

Chinese officials have reportedly shifted their stance on trade because after agreeing to changes to their intellectual-property policies, they have not received assurances from the Trump administration that tariffs imposed on their exports would be lifted, curbing hopes of a deal.

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin reportedly plan to travel to China next week for another round of trade talks with Chinese Vice Premier Liu He.

0 thoughts on “Broader market witness selling pressure”