Fortunately, the UCP (unitary cooling product) segment has been steadily growing, both in terms of sales and profitability.

Revenues of the UCP segment have increased 20% and 10%, respectively, for Voltas and Blue Star. On the back of increasing sales of air conditioners (ACs), earnings before interest and tax of Voltas’s UCP division rose 67% and that of Blue Star gained 46% in Q2.

Interestingly, compared to the pain seen in some segments of discretionary spending such as automobiles, the AC market has bucked the trend. In fact, sales had perked up on the back of sizzling summer and a delayed monsoon this calendar year. That said, analysts reckon AC sales are increasing with higher penetration in smaller cities, higher traction on e-commerce platforms and through a retail financing push.

Strong performance of the UCP segment that contributes over a third of the total sales has improved investor sentiment. The recent rally in shares of both Voltas and Blue Star has seen the price-to-earnings multiple soar to about 28-30 times estimated FY21 earnings.

With the peak season for AC sales behind and stiff competition that may cap margin expansion, traction in EMP segment revenue is critical for sustaining overall profits and valuations of both Voltas and Blue Star.

" />

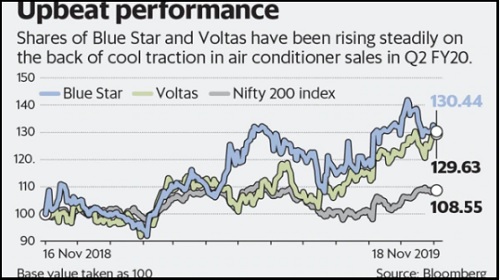

Shares of both Blue Star Ltd and Voltas Ltd are up 20% and 25%, respectively, since August, beating the 8% rise in the benchmark Nifty 200 index.

September quarter’s (Q2 FY20) improved order flows in the EMP (electro-mechanical projects and services) segment lent confidence to investors about revenue growth in the coming quarters.

Voltas’s order book rose to ₹6,600 crore, which brings revenue visibility for about 12-18 months. Blue Star’s fresh orders during the quarter rose 11%, taking the total order book to about ₹3,000 crore.

Of course, weak industrial capex in domestic markets continues to impact large domestic orders. The EMP segment’s revenue growth was a tad lower than analysts’ expectations in Q2 for both firms. Voltas’s segment revenue dipped by 10% year-on-year and profit before interest and tax as a percentage of sales fell 150 basis points. Blue Star, on the other hand, fared better clocking a 24% revenue growth, although margins fell even in its case.

Fortunately, the UCP (unitary cooling product) segment has been steadily growing, both in terms of sales and profitability.

Revenues of the UCP segment have increased 20% and 10%, respectively, for Voltas and Blue Star. On the back of increasing sales of air conditioners (ACs), earnings before interest and tax of Voltas’s UCP division rose 67% and that of Blue Star gained 46% in Q2.

Interestingly, compared to the pain seen in some segments of discretionary spending such as automobiles, the AC market has bucked the trend. In fact, sales had perked up on the back of sizzling summer and a delayed monsoon this calendar year. That said, analysts reckon AC sales are increasing with higher penetration in smaller cities, higher traction on e-commerce platforms and through a retail financing push.

Strong performance of the UCP segment that contributes over a third of the total sales has improved investor sentiment. The recent rally in shares of both Voltas and Blue Star has seen the price-to-earnings multiple soar to about 28-30 times estimated FY21 earnings.

With the peak season for AC sales behind and stiff competition that may cap margin expansion, traction in EMP segment revenue is critical for sustaining overall profits and valuations of both Voltas and Blue Star.

0 thoughts on “Blue Star Voltas shares heat up as order flows and AC sales pick up”