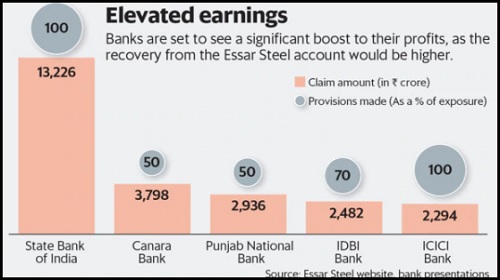

Granted, Essar Steel’s closure has established the primacy of lenders in the resolution process. Also, the recovery for banks would be close to 90%, analysts estimate, instead of the 60% expected earlier. Surely, banks will see huge write-backs in provisions and a boost to profit in the third quarter.

“While the SC does ask the COC (committee of creditors) to consider operational creditors as well, we believe recovery for banks in the Essar Steel case will be closer to 90% (as suggested by COC) versus 60% (as suggested by the NCLAT)—within our coverage universe, the key beneficiaries should be SBI followed by ICICI Bank," said analysts at Nomura Financial Advisory and Securities (India) Pvt. Ltd in a note. NCLAT is National Company Law Appellate Tribunal.

But this win should not make banks and investors complacent. There are still large accounts to be resolved and the insolvency courts have shown no signs of a speedy process. Essar Steel took 830 days to exit the courts. There are many still doing the rounds of insolvency courts beyond the stipulated time frame of 270 days for resolution.

According to data from the Insolvency and Bankruptcy Board of India, the average time for cases to be resolved was 374 days, against the mandated 270-day limit under the Insolvency and Bankruptcy Code. As of September, 535 cases languished in the courts for more than 270 days.

If we look at the largest lender, State Bank of India (SBI), it has 540 accounts totalling more than ₹1 trillion held up in the courts. SBI chairman Rajnish Kumar has been reminding investors of the large recovery Essar Steel will bring. The public sector bank will get a boost of ₹12,000 crore in the December quarter as it had provided 100% for the account.

But SBI’s stressed exposure includes ₹29,000 crore through DHFL, Indiabulls Group and Vodafone Idea, according to Nomura.

The pain from DHFL and Essel Group is big and the telecom sector has emerged as a new point of stress.

As past stressed loans get resolved, new trouble is brewing. Therefore, banks are not off the hook yet as far as stress is concerned and investors would do well in exercising some caution. For now, lenders can enjoy a bit a of a sunshine in a long winter.

" />

The closure of the Essar Steel insolvency case, one of the first set of 12 large defaulting accounts referred under a nascent code, is a victory for banks.

But beyond this steelmaker promoted by the Ruia family, lies a minefield of stressed loans that threatens to upset the earnings of banks. Essel Group, Dewan Housing Finance Corp. Ltd (DHFL) and Vodafone Idea Ltd are but a handful of those accounts.

Banks have been hacking through their bad loan pile for three years now, but it still is at a formidable ₹9.15 trillion as of September. The above names are still to be tagged bad, which would be added to this pile once they are termed as non-performing.

Granted, Essar Steel’s closure has established the primacy of lenders in the resolution process. Also, the recovery for banks would be close to 90%, analysts estimate, instead of the 60% expected earlier. Surely, banks will see huge write-backs in provisions and a boost to profit in the third quarter.

“While the SC does ask the COC (committee of creditors) to consider operational creditors as well, we believe recovery for banks in the Essar Steel case will be closer to 90% (as suggested by COC) versus 60% (as suggested by the NCLAT)—within our coverage universe, the key beneficiaries should be SBI followed by ICICI Bank," said analysts at Nomura Financial Advisory and Securities (India) Pvt. Ltd in a note. NCLAT is National Company Law Appellate Tribunal.

But this win should not make banks and investors complacent. There are still large accounts to be resolved and the insolvency courts have shown no signs of a speedy process. Essar Steel took 830 days to exit the courts. There are many still doing the rounds of insolvency courts beyond the stipulated time frame of 270 days for resolution.

According to data from the Insolvency and Bankruptcy Board of India, the average time for cases to be resolved was 374 days, against the mandated 270-day limit under the Insolvency and Bankruptcy Code. As of September, 535 cases languished in the courts for more than 270 days.

If we look at the largest lender, State Bank of India (SBI), it has 540 accounts totalling more than ₹1 trillion held up in the courts. SBI chairman Rajnish Kumar has been reminding investors of the large recovery Essar Steel will bring. The public sector bank will get a boost of ₹12,000 crore in the December quarter as it had provided 100% for the account.

But SBI’s stressed exposure includes ₹29,000 crore through DHFL, Indiabulls Group and Vodafone Idea, according to Nomura.

The pain from DHFL and Essel Group is big and the telecom sector has emerged as a new point of stress.

As past stressed loans get resolved, new trouble is brewing. Therefore, banks are not off the hook yet as far as stress is concerned and investors would do well in exercising some caution. For now, lenders can enjoy a bit a of a sunshine in a long winter.

0 thoughts on “Beyond Essar Steel case awaits a minefield of bad loans for lenders”