Key benchmark indices were trading with small losses in early trade. At 9:20 IST, the barometer index, the S&P BSE Sensex, was down 13.14 points or 0.04% at 36,199.77. The Nifty 50 index was down 15 points or 0.14% at 10,840.15.

Among secondary barometers, the BSE Mid-Cap index was up 0.09%. The BSE Small-Cap index was up 0.08%.

The market breadth, indicating the overall health of the market, was positive. On BSE, 555 shares rose and 386 shares fell. A total of 49 shares were unchanged.

Overseas, most Asian shares were trading higher. China's Producer Price Index (PPI), which measures price increases before they reach the consumer, in December rose 0.9% on-year. That compares with the a 2.7% year-on-year increase in November. China's December consumer inflation (CPI), a gauge of prices for goods and services, rose 1.9% on year. The CPI rose 2.2% in November.

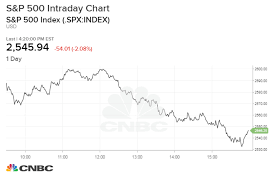

US stocks closed higher for a fourth session Wednesday, on reports that the US and China have narrowed differences over trade. Minutes from the December's Federal Open Market Committee meeting, which indicated caution on future interest rate hikes, also helped to buoy sentiment.

The US and China wrapped up their first face-to-face trade negotiations since a temporary tariff truce was declared last month. In a statement released after talks concluded, the US trade representative's office said officials had discussed making any deal subject to ongoing verification and effective enforcement. The statement added that negotiators had conveyed President Trump's commitment to addressing our persistent trade deficit and to resolving structural issues in order to improve trade between our countries.

China's commerce ministry said on Thursday trade talks with the United States this week were extensive and detailed, and established a foundation for the resolution of each others' concerns.

Meanwhile, the release of Fed minutes revealed that some central-bank officials hard reservations about an interest-rate increase last month due to market volatility, though policy makers voted unanimously in favor of the move. They also recommended the Fed should be patient and stressed that a relatively limited amount of additional tightening is appropriate.

Back home, IT major TCS was up 0.35%. The company announces its Q3 December 2018 result today, 10 January 2019.

Ashok Leyland was up 1.54%. The company confirmed that it bagged orders from IRT (Institute of Road Transport, Chennai), UPSRTC (Uttar Pradesh State Roadways Transport Corporation) and CTU (Chandigarh Transport Undertaking) for 2,580 buses. All these buses can be delivered before March 2019. The announcement was made after market hours yesterday, 9 January 2019.

Adani Enterprises was up 0.64%. The company said that the Government of Andhra Pradesh (GoAP) has signed a MoU with the Adani Group to build Data Center Parks up to 5 GW capacities in and around Visakhapatnam over the next 20 years. This ambitious project would be a first-of-its-kind 100% renewable energy powered project in the world. The announcement was made after market hours yesterday, 9 January 2019.

Delta Corp was down 2.52%. The company's consolidated net profit rose 12.94% to Rs 50.53 crore on 24.23% rise in total income to Rs 211.32 crore in Q3 December 2018 over Q3 December 2017. The announcement was made after market hours yesterday, 9 January 2019.

AGC Networks was up 5.82%. The company announced that its wholly-owned subsidiary has completed the acquisition of Black Box Corporation, a leading digital solutions provider in the US. The combination with Black Box will substantially strengthen AGC's presence and offerings to 25+ countries across six continents. The announcement was made after market hours yesterday, 9 January 2019.

0 thoughts on “Benchmarks trade with small losses”