Key equity indices trimmed some losses in early afternoon trade. At 12:21 IST, the barometer index, the S&P BSE Sensex, was down 539.89 points or 1.51% at 35,133.36. The Nifty 50 index was down 162.55 points or 1.52% at 10,531.15.

Domestic market followed weakness in other Asian shares amid rising tensions between the US and China as well as disappointing Chinese trade data for November. The exit polls on state assembly elections also made investors jittery. Investors are bracing for the state election results that will be out on Tuesday.

Among secondary barometers, the BSE Mid-Cap index was down 1.39%. The BSE Small-Cap index was down 1.49%.

The market breadth, indicating the overall health of the market, was weak. On BSE, 514 shares rose and 1751 shares fell. A total of 111 shares were unchanged.

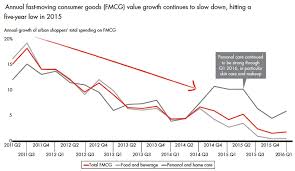

FMCG shares declined across the board. Godrej Consumer Products (down 2.2%), Colgate Palmolive (India) (down 2.05%), Britannia Industries (down 2.02%), Procter & Gamble Hygiene & Health Care (down 1.63%), Jyothy Laboratories (down 1.45%), Bajaj Corp (down 1.37%), Dabur India (down 1.19%), Tata Global Beverages (down 1.16%), Hindustan Unilever (down 0.98%), Marico (down 0.76%), Nestle India (down 0.34%) and GlaxoSmithKline Consumer Healthcare (down 0.16%), edged lower.

Most IT shares declined. Oracle Financial Services Software (down 3.5%), MphasiS (down 2.54%), Persistent Systems (down 2.14%), MindTree (down 1.51%), Infosys (down 1.34%), Wipro (down 1.26%), HCL Technologies (down 1.2%) and TCS (down 0.16%), edged lower. Tech Mahindra (up 0.61%) and Hexaware Technologies (up 0.77%), edged higher.

Tata Sponge Iron rose 0.94% after the government gave environmental clearance to increase the production capacity at the company's existing facility located at Village Bileipada, Odisha. The announcement was made after market hours on Friday, 7 December 2018.

Tata Sponge Iron said that the Ministry of Environment, Forest and Climate Change, Government of India (MoEFCC), has considered the company's application and subject to certain conditions, decided to accord environmental clearance for the enhancement of DRI production from 4,25,000 TPA to 4,65,000 TPA in the company's existing facility located at Village Bileipada, Tehsil Barbil, District Keonjhar, Odisha.

Ashoka Buildcon advanced 7.28% after the company announced receipt of a letter of acceptance for railway project from Rail Vikas Nigam. The announcement was made on Saturday, 8 December 2018.

Ashoka Buildcon said that the company has received Letter of Acceptance by Rail Vikas Nigam, for the project viz. 'construction of roadbed, bridges, supply of ballast, installation of track (excluding supply of rails, and track sleepers), electrical (general electrification), provision of OHE, signaling and telecommunication works in connection with third line from Sonnagar to Garhwa Road in Dhanbad division of East Central Railway,' in the States of Bihar and Jharkhand (Project) in 2 packages (Package 1 & Package 2). The company had bid the Project in Joint Venture with Story Tech Services LLC, wherein the company is a lead member. The aggregate accepted bid value of the project is Rs 794.20 crore.

On the economic front, India's current account deficit (CAD) increased to US$ 19.1 billion (2.9% of GDP) in Q2 of 2018-19 increased from US$ 6.9 billion (1.1% of GDP) in Q2 of 2017-18 and US$ 15.9 billion (2.4% of GDP) in the preceding quarter. The widening of the CAD on a year-on-year (y-o-y) basis was primarily on account of a higher trade deficit at US$ 50.0 billion as compared with US$ 32.5 billion a year ago.

On the political front, market participants are awaiting poll results of five state elections due on 11 December 2018. The outcomes of the assembly elections will likely set the tone for the general elections next year. Voting in Rajasthan and Telangana took place on 7 December 2018. Assembly elections in Madhya Pradesh and Mizoram were held on 28 November 2018. The election in Chhattisgarh Assembly was held in two phases on 12 and 20 November 2018. The counting of votes in all the states will be done on 11 December 2018.

Exit polls on Friday reportedly indicated that the Bharatiya Janata Party risks losing control of Rajasthan to the Congress and faces a close fight in Madhya Pradesh and Chhattisgarh.

Overseas, Asian shares traded lower Monday following weaker-than-expected Chinese trade data released over the weekend.

China's November exports only rose 5.4% from a year earlier, Chinese customs data showed on Saturday. The customs data showed that annual growth for exports to all of China's major partners slowed significantly. Exports to the United States rose 9.8% in November from a year earlier, compared with 13.2% in October. Import growth was 3%, the slowest since October 2016. Imports of iron ore fell for a second time, reflecting waning restocking demand at steel-mills as profit margins narrow.

Meanwhile, China protested the arrest of a senior executive of Chinese electronics giant Huawei, who is suspected of trying to evade US trade curbs on Iran. US and China recently agreed to hold off on imposing further tariffs for 90 days while they attempt to resolve a range of issues from trade to technology development. The arrest could jeopardize the truce that was just agreed.

US stocks closed sharply lower on Friday as a lack of concrete progress toward reducing US-China trade tensions bolstered risk-off sentiment and overshadowed the November employment report.

Nonfarm payrolls increased by 155,000 for the month while the unemployment rate again held at 3.7%, its lowest since 1969, the Labor Department reported Friday.

Meanwhile, the University of Michigan consumer sentiment index came in at 97.5. Further, consumer credit grew at its fastest pace in 11 months in October, the Federal Reserve reported.

Oil producer club OPEC and some non-affiliated producers agreed a supply cut of 1.2 million barrels per day (bpd) from January. Despite this, the outlook for next year remains muted on the back of an economic slowdown.

0 thoughts on “Barometers trim losses FMCG shares decline”