At the current market price, the government’s stake in BPCL is valued at ₹48,700 crore.

Eventually, the selected bidder will have to make an open offer to acquire a minimum of 26% shares (or voting rights) of BPCL. “The follow-up open offer will provide an upside of control premium to BPCL’s minorities and stated exclusion of CPSEs from bidding will allay concerns on Indian Oil Corp. Ltd," analysts at Kotak Institutional Equities said in a report on Monday.

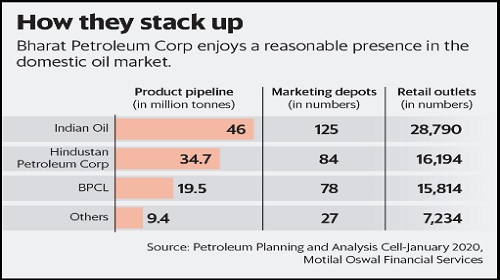

The domestic petroleum market also remains an attractive one, offering a good growth story for the acquirer.

But analysts at Motilal Oswal Securities Ltd point out that the information memorandum is silent on some key aspects, such as (a) guarantee of non-interference in pricing of auto fuels even if oil surges, (b) complexities involved in dealing with subsidiaries and joint ventures, and (c) high employee cost.

While the government has begun on the right note, it would do well to fine tune the rest of the disinvestment process to ensure success.

" />

Shares of Bharat Petroleum Corp. Ltd (BPCL) stood out with a more than 5% gain on Monday, amid the carnage in equities, with investors perceiving almost any news to be bad news.

This could be attributed to the cut in crude oil prices by state-run Saudi Arabian Oil Co., which is expected to help the second-largest public sector oil marketing company in India.

Another positive was the government’s preliminary information memorandum for inviting expression of interest for the strategic disinvestment in BPCL.

Government firms are not eligible to bid for the proposed transaction. This takes the pressure off state-run firms such as Indian Oil Corp Ltd.

This is significant as Oil and Natural Gas Corp. Ltd (ONGC) had acquired the government’s stake in Hindustan Petroleum Corp. Ltd in 2018, and that had weighed on investor sentiment for the ONGC stock in recent years.

Besides, the entry of a private sector firm could bring in better efficiencies.

Second, the government has put up its entire stake of 52.98% for sale (excluding BPCL’s equity shareholding in Numaligarh Refinery). This means that the new buyer would have full control of the business, an encouraging prospect for any suitor.

At the current market price, the government’s stake in BPCL is valued at ₹48,700 crore.

Eventually, the selected bidder will have to make an open offer to acquire a minimum of 26% shares (or voting rights) of BPCL. “The follow-up open offer will provide an upside of control premium to BPCL’s minorities and stated exclusion of CPSEs from bidding will allay concerns on Indian Oil Corp. Ltd," analysts at Kotak Institutional Equities said in a report on Monday.

The domestic petroleum market also remains an attractive one, offering a good growth story for the acquirer.

But analysts at Motilal Oswal Securities Ltd point out that the information memorandum is silent on some key aspects, such as (a) guarantee of non-interference in pricing of auto fuels even if oil surges, (b) complexities involved in dealing with subsidiaries and joint ventures, and (c) high employee cost.

While the government has begun on the right note, it would do well to fine tune the rest of the disinvestment process to ensure success.

0 thoughts on “BPCL disinvestment starts off on right note; some challenges stay”