Headline indices of the Australian equity market tumbled on Monday, 08 July 2019, as profit booking triggered on tracking fall in Wall Street last Friday after solid US non-farm payrolls print dampened market expectations the Federal Reserve would cut rates more than twice this year. Meanwhile selloff pressure mounted on geopolitical worries linked to Iran. At closing bell, the benchmark S&P/ASX200 index dropped 79.08 points, or 1.17%, at 6,672.20 points, while the broader All Ordinaries shed 74.36 points, or 1.09%, at 6,757.40. Last week, the All Ords closed just 21 points shy of an all-time high last week.

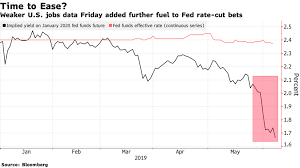

US stocks retreated from records and lost ground last Friday as better-than-expected US job data clouded investors' hopes for steep cuts in interest rates in the world's biggest economy. The U.S. jobs report showed the economy stateside added better than expected 224,000 jobs in June, following a dismal jobs print in May. The solid US payrolls report dampened Fed rate cut expectations and severely dented the argument for a 50bps rate cut by the end of the month.

Geopolitical concerns was also weighing on the market following news on Sunday that Iran had breached the nuclear deal's cap on its stockpile of low-enriched uranium.

Shares of financial were lower Credit Suisse downgraded its earnings expectations for each of the commercial banks on the back of the latest rate cut and warned they would struggle to pass through even a majority of a future cut. Commonwealth Bank led the losses falling 1.2% to A$81.28, Westpac dropped 1.2% to A$28.02, ANZ declined 1% to A$27.88 and NAB closed the session at A$26.75, down 0.8%.Bendigo & Adelaide Bank slid 1.5% to $11.39 and Bank of Queensland lost 1.2% to end the day at A$9.44.

Infrastructure and real estate investment trust stocks were weaker on Monday as Australian bond yields rose firmly. Goodman Group fell 3.8% to $15.46, Transurban slid 1.3% to A$15.12, Scentre Group dropped 1.9% to A$4.05 and Dexus declined 2.3% to A$13.58.

The materials stocks declined after the price of iron ore fell heavily. BHP Group slid 1.8% to A$40.56 and Rio Tinto fell 1% to A$102.91.

CURRENCY NEWS: The Australian dollar softened against the U.S. dollar on Monday. The Australian dollar changed hands at $0.6987 following levels above $0.702 seen in the previous week.

0 thoughts on “Australia Market falls on fading hopes of Fed rate cut”