Headline indices of the Australian equity market declined for second day in row on Tuesday, 09 July 2019, following decline in Wall Street overnight on a re-think that the US Fed Reserve will cut interest rates in July after better than expected jobs growth numbers late last week. ASX sectors mostly declined, with losses in the big banks after APRA amended its timeline for extra capital raising offsetting gains in major mining stocks on positive outlook for iron ore prices. Around late afternoon, the benchmark S&P/ASX200 index dropped 15.45 points, or 0.23%, at 6,656.80 points, while the broader All Ordinaries shed 15.31 points, or 0.23%, at 6,742.10.

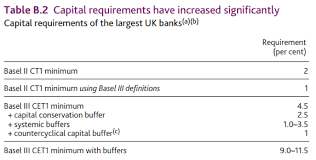

Shares of financials declined, with major four lenders leading losses after the Australian Prudential Regulation Authority (APRA) said on Tuesday it will raise capital requirements for banks by 3%age points of risk-weighted assets. This is to cover for any potential major downturn, avoiding a situation like the 2008 financial crisis where banks around the world needed to be bailed out by the government. The big four banks - ANZ Banking, National Australia Bank, Westpac and Commonwealth Bank - were lower in a range of 0.2% to 0.8%.

The materials stocks inclined after rating agency S&P raised its iron ore price forecasts for 2019, 2020 and 2021 as it expected a prolonged hit to supply from the Vale dam disaster in January. Mining giant BHP Group and Fortescue Metals grew almost 2% each, while Rio Tinto was higher by more than 1%.

Consumer stocks inclined despite a weaker consumer confidence reading for the previous week, following the RBA cutting interest rates for a second straight month in July. Domino's Pizza (DMP) rose 3% while Breville Group (BRG) was 3.9% higher. Supermarket giant Coles Group (COL) gained 1.3%.

CURRENCY NEWS: The Australian dollar softened against the U.S. dollar on Tuesday, partly reflecting waning optimism about a near-term interest rate cut following last Friday's much better than expected jobs data. The Australian dollar was quoted at $0.6973, compared to $0.6986 on Monday

0 thoughts on “Australia Market falls on banks after capital requirements”