Given that the payouts are confined to less than 3-4% of the employee base, the incremental impact on the wage bill should not be more than 30 basis points, says an analyst, on condition of anonymity. A basis point is one-hundredth of a percentage point. In any case, the cost of salaries to offshore employees is only about 20% of revenue.

Further, with recent measures beginning to yield results—reflective in sequential improvement in operating margins in Q2—Infosys can afford to share the benefits with the employees, says the analyst.

In a post-earnings call with analysts in October, chief executive officer Salil Parekh said the investments made by the company after his appointment are complete. The focus on cost and operational improvement measures are yielding benefits. Although Infosys refrained from providing guidance beyond the current fiscal year, it alluded to better profitability in the second half of FY20. “(In) H1 we are (at) 21.1%, we are within the (guidance) band and I think this is a good place to grow from here and that is what we are looking at," the management told analysts.

The commentary on investments and near-term profitability has led to the belief that profitability is on the mend at Infosys. “We reckon that margin bottomed out in 1QFY20 and expect a steady trajectory as the investments start yielding results," HDFC Securities Institutional Research said in a note last month.

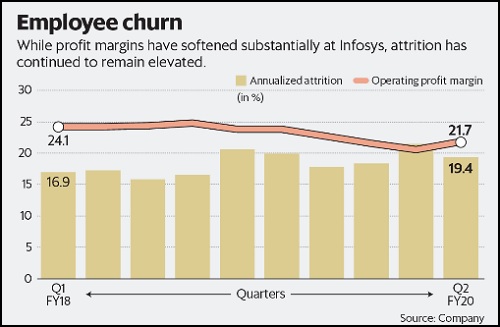

As the company stepped up investments, operating profit margins dropped from 24.7% at the end of FY18 to 20.5% in June this year (Q1 FY20). In the September quarter, they improved to 21.7%.

The recent recalibration towards digital technologies and pressure on traditional business impacted profitability across firms. But the impact was more pronounced at Infosys. Industry leader Tata Consultancy Services Ltd saw a margin impact of less than 1.5 percentage points from end-FY18 to June quarter this year.

While high attrition may warrant elevated payouts from Infosys, as pointed earlier, the impact on overall costs will be contained as only a small proportion of employees will be covered. The worry is whether the recent happenings at the company with regards to the whistleblower complaint result in some churn at the top. While there is no evidence of this happening, investors appear to be hedging their bets, suggests the Infosys stock.

More clarity will emerge when the company releases the current quarter’s earnings.

" />

Infosys Ltd’s shares have recovered about 60% from the lows of ₹635 apiece touched after news of a whistleblower complaint surfaced. While none of the charges have been substantiated, investors are still hedging some of their bets.

Meanwhile, news reports suggest the company is fighting another battle—high attrition among its employees. A news report in the Business Standard said Infosys is offering special incentives to top performers to check attrition.

Attrition has remained steadfastly high at the company. From less than 17% at the beginning of FY18, annualized attrition rose to 20% in Q1 of FY19 and remained at that level ever since.

Given that the payouts are confined to less than 3-4% of the employee base, the incremental impact on the wage bill should not be more than 30 basis points, says an analyst, on condition of anonymity. A basis point is one-hundredth of a percentage point. In any case, the cost of salaries to offshore employees is only about 20% of revenue.

Further, with recent measures beginning to yield results—reflective in sequential improvement in operating margins in Q2—Infosys can afford to share the benefits with the employees, says the analyst.

In a post-earnings call with analysts in October, chief executive officer Salil Parekh said the investments made by the company after his appointment are complete. The focus on cost and operational improvement measures are yielding benefits. Although Infosys refrained from providing guidance beyond the current fiscal year, it alluded to better profitability in the second half of FY20. “(In) H1 we are (at) 21.1%, we are within the (guidance) band and I think this is a good place to grow from here and that is what we are looking at," the management told analysts.

The commentary on investments and near-term profitability has led to the belief that profitability is on the mend at Infosys. “We reckon that margin bottomed out in 1QFY20 and expect a steady trajectory as the investments start yielding results," HDFC Securities Institutional Research said in a note last month.

As the company stepped up investments, operating profit margins dropped from 24.7% at the end of FY18 to 20.5% in June this year (Q1 FY20). In the September quarter, they improved to 21.7%.

The recent recalibration towards digital technologies and pressure on traditional business impacted profitability across firms. But the impact was more pronounced at Infosys. Industry leader Tata Consultancy Services Ltd saw a margin impact of less than 1.5 percentage points from end-FY18 to June quarter this year.

While high attrition may warrant elevated payouts from Infosys, as pointed earlier, the impact on overall costs will be contained as only a small proportion of employees will be covered. The worry is whether the recent happenings at the company with regards to the whistleblower complaint result in some churn at the top. While there is no evidence of this happening, investors appear to be hedging their bets, suggests the Infosys stock.

More clarity will emerge when the company releases the current quarter’s earnings.

0 thoughts on “As Infosys steps up payouts for staffers familiar concerns arise”