ABB India is facing headwinds just like its peers in the capital goods industry. With the Index of Industrial Production hitting an eight-year low and the capital goods industry showing a sharp contraction, order flows in the quarters ahead may be impacted.

Even in the September quarter, ABB India’s order flows rose by only 5% year-on-year. And the 14% year-on-year drop in order backlog to ₹4,372 crore is worrisome, given that it is less than a year’s annual revenue.

T.K. Sridhar, chief financial officer of the firm, said, “We are diversifying business risk by tapping new sectors and catering to customers in Tier-2 and Tier-3 cities." The shift in the nature of business from large-ticket projects to short-cycle orders would lower dependence on few business industries, he added.

So, while ABB India has steered well through headwinds in the economy, deepening slowdown and weak impact of government measures to revive capex could stymie order flows even in the coming quarters. In this context, the stock’s price-to-earning multiple of about 80 times CY20 earnings is expensive capping near-term upsides.

" />

ABB India Ltd’s stock rose 2.8% after the capital goods manufacturer clocked an impressive growth in revenue and profits in spite of the current slowdown.

Restructuring by the Indian arm of the Swiss-Swedish multinational company to focus on new-age businesses by tapping growth pockets in the economy is paying off.

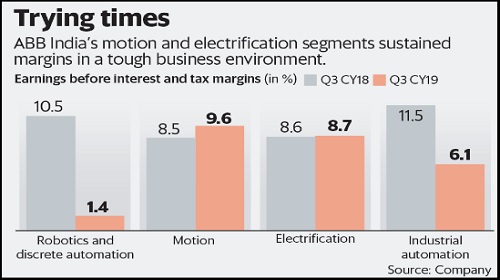

Revenue grew 17% year-on-year to ₹1,746 crore, powered by the motion and electrification segments that together comprise 75% of the business.These segments cater to power distribution, Metro and railways. Industrial automation fared well too. But, revenue from the robotics and discrete automation segment, which caters to the auto sector, fell sharply.

However, a focus on profitability led to an 89% jump in operating profit for ABB India during the quarter.

Indeed, benign raw material costs helped. However, analysts reckon that the company’s technological edge in new areas has so far raked in orders with reasonably good margins. According to Arafat Saiyed, research analyst at Reliance Securities Ltd, “Higher sales, cost-saving measures, favourable portfolio mix and digital value-addition has aided profitability."

ABB India is facing headwinds just like its peers in the capital goods industry. With the Index of Industrial Production hitting an eight-year low and the capital goods industry showing a sharp contraction, order flows in the quarters ahead may be impacted.

Even in the September quarter, ABB India’s order flows rose by only 5% year-on-year. And the 14% year-on-year drop in order backlog to ₹4,372 crore is worrisome, given that it is less than a year’s annual revenue.

T.K. Sridhar, chief financial officer of the firm, said, “We are diversifying business risk by tapping new sectors and catering to customers in Tier-2 and Tier-3 cities." The shift in the nature of business from large-ticket projects to short-cycle orders would lower dependence on few business industries, he added.

So, while ABB India has steered well through headwinds in the economy, deepening slowdown and weak impact of government measures to revive capex could stymie order flows even in the coming quarters. In this context, the stock’s price-to-earning multiple of about 80 times CY20 earnings is expensive capping near-term upsides.

0 thoughts on “ABB India pulls off strong profit growth order flow woes remain”