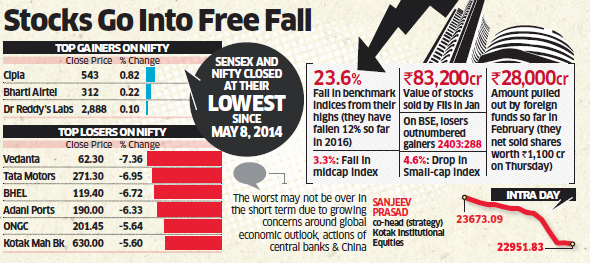

Indian stock market for the whole day the color of the graph is red for all the sectors and we are able to see a panic session which is more than 21 month low which Nifty traded nearly -3.5% downside. Nifty Future made a low 6993 from 7205 which is 222 points down, nobody expected in single day the market will crash within hours. The sensex on Thursday closed 807.07 points down at 22,951.83 points the lowest closing level for the index since May 8, 2014. Intraday slumped 849.78 points to 22909.10 which is 52 week low. This was also the fourth straight session of losses for the index which has fallen by 1,665 points.

Investors and Traders as a whole made a loss of 3 lakh crore on Thursday. FIIs made a big withdrawal from Indian market of Rs 83200 crore withdrawal which is higher since past 24 months. There are many factors which affected on that single day, we can see each below given the biggest intraday falls in Indian market.

12 biggest Intra-day Sensex falls

? 24 August, 2015 — 1,624.51 points

? 21 January, 2008 — 1,408.35 points

? 24 October, 2008 — 1,070.63 points

? 17 March, 2008 — 951.03 points

? 3 March, 2008 — 900.84 points

? 22 January, 2008 — 875 points

? 6 July, 2009 — 869.65 points

? 6 January, 2015 — 854.86 points

? 11 February, 2008 — 833.98 points

? 18 May, 2006 — 826 points

? 11 February, 2016 — 807 points

Above data credit : Economic Times

Why this bloodbath on Thursday

6. Big sell off in European markets. FTSE100 down 2,61 per cent, Germany’s DAX 3.14 per cent, French CAC40 3.55 per cent.

7. The rupee plunged to a 29-month low against the dollar, ending at 68.30 down 0.65% from Wednesday’s close. The local currency USD-INR is fast approaching its all-time low of 68.85, touched on August 28 2013.

It is not the right time for Investors as market may correct and we do not try to catch the falling knife, which is risky and it may hurt our hands surely. So still wait for the best stocks to choose, we may see all popular blue chip companies may trade for cheap prices, but its time being not a real one to start for growth.

Intraday traders alone happy in 2016 till now