The announcement was made after market hours yesterday, 15 November 2018.

Meanwhile, the S&P BSE Sensex was up 169.48 points or 0.48% at 35,430.02

On the BSE, 1,316 shares were traded in the counter so far as against average daily volume of 6,909 shares in the past two weeks. The stock had hit a high of Rs 29.95 and a low of Rs 29.45 so far during the day.

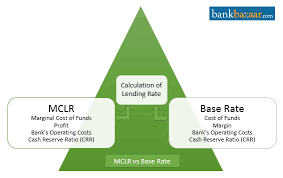

Punjab & Sind Bank has reviewed the Marginal Cost of Fund Based Lending Rate (MCLR) for different tenors effective from 16 November 2018. Overnight marginal cost of funds was fixed at 8%, one month MCLR was fixed at 8.2%, three month MCLR was fixed at 8.4%, six months MCLR was fixed at 8.5%, one year MCLR was fixed at 8.8% and three years MCLR was fixed at 9.1%.

Punjab & Sind Bank reported net loss of Rs 109.23 crore in Q2 September 2018 as compared with net profit of Rs 13.70 crore in Q2 September 2017. Total income rose 11.2% to Rs 2409.41 crore in Q2 September 2018 over Q2 September 2017.

The Government of India held 85.557% in Punjab & Sind Bank (as per the shareholding pattern as on 30 September 2018).

0 thoughts on “Punjab Sind Bank inches higher after setting MCLR”