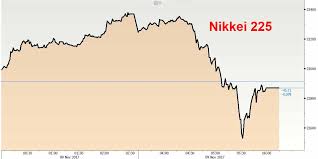

Headline indices of the Japan share market dropped on Monday, 10 December 2018, as risk aversion selloff triggered on following the sell-off on Wall Street Friday after the release of disappointing U.S. jobs data for the month of November. Meanwhile, investor sentiment dampened on worries about slowdown in global economic growth after the world's largest economies - the United States, China and Japan - all reporting weaker-than-expected data. Selloff pressure fuelled further on fears that a fresh flare-up in tensions between Washington and Beijing could quash any chances of a trade deal. Total 31 out of 33 issues of Topix index declined, with shares in Air Transportation, Electric Appliances, Foods, Services, Chemicals, and Glass & Ceramics Products issues being notable losers. In late afternoon trades, the 225-issue Nikkei index dropped 487.45 points, or 2.3%, at 21,191.23. The broader Topix index of all First Section issues on the Tokyo Stock Exchange fell 32.58 points, or 2%, to 1,587.87.

Shares of exporters were mostly lower as the safe-haven yen strengthened against the U.S. dollar. Canon, Sony Corp, Advantest, Tokyo Electron, Honda, Toyota, Mitsubishi Electric and Panasonic were lower in range of 1% to 3%.

Among individual stocks, Pioneer Corp. tumbled more than 28% following news that private equity firm Baring Private Equity will buy the cash-strapped electronics firm for $900 million.

CURRENCY NEWS: The Japanese yen, which can be a haven during market uncertainty, appreciated in the mid-112 yen range against dollar, after a weak US session Friday, signs China's economy remains under pressure and a potential escalation of tensions between Washington and Beijing. The dollar was quoted at 112.53-54 yen compared with 112.69-79 yen in New York and 112.77-78 yen on Friday in Tokyo. The euro, meanwhile, fetched 128.30-34 yen against 128.47-57 yen in New York and 128.24-28 yen in late Friday trade in Tokyo.

OFFSHORE MARKET: US stock market closed down on Friday, as a data showed that U.S. job growth accelerated much less than forecast in November, casting uncertainty over the pace of rate increases for next year. The report said non-farm payroll employment rose by 155,000 jobs in November after surging by a downwardly revised 237,000 jobs in October. The Dow Jones Industrial Average tumbled 558.72 points or 2.2% to 24,388.95. The S&P 500 slumped 62.87 points or 2.3% to 2,633.08, while the Nasdaq Composite plunged 219.01 points or 3.1% to 6,969.25.

0 thoughts on “Japan Nikkei tumbles on trade and growth worries”