Headline indices of the Japan share market tumbled on Thursday, 20 December 2018, as risk aversion selloff triggered on tracking the decline in Wall Street overnight after the U.S. Federal Reserve raised rates and noted the need for further hikes year, defying expectations for a more dovish stance. Investors remained cautious ahead of the U Bank of Japan's monetary policy decision due later today. Total 32 issues out of 33 issues of the Topix index declined, with shares in Marine Transportation, Securities & Commodities Futures, Machinery, Electric Appliances, Glass & Ceramics Products, and Nonferrous Metals issues being notable losers. In late afternoon trade, the 225-issue Nikkei index fell 531.25 points, or 2.5%, at 20,456.67. The broader Topix index of all First Section issues on the Tokyo Stock Exchange shed 34.12 points, or 2.2%, to 1,522.

Shares of exporter were mostly lower. Panasonic, Sony, Mitsubishi Electric and Canon were lower in the range of 1% to 2%. Tech companies Advantest fell more than 2% and Tokyo Electron dipped 1%.Shares of banks were among the losers, with Mitsubishi UFJ Financial trading down 0.73% and its rival Sumitomo Mitsui Financial down 0.6%.

Among individual stocks, Taisho Pharmaceutical rose 0.84% after news that it will acquire US-based Bristol-Myers' French unit UPSA for US$1.6 billion.

Shares of SoftBank Corp., the mobile unit of tech giant SoftBank Group, were down almost 1% after dropping 7.6% at the open. Trading was suspended for a few minutes after the opening bell because sell orders overwhelmed buy orders. The fall came after a bruising debut for SoftBank Corp yesterday, which saw shares finishing 14.5% lower than the IPO price.

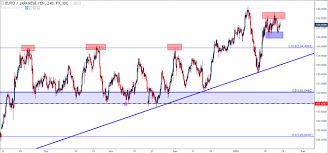

CURRENCY NEWS: The Japanese yen, which can be a haven during market uncertainty, appreciated in the lower 112 yen zone against dollar on Thursday, after the Federal Reserve raised interest rates as expected and projected two increases next year. Investors are also cautious as they look ahead to the Bank of Japan's monetary policy decision due later in the day. The dollar was quoted at 112.42-43 yen compared with 112.44-54 yen in New York and 112.40-41 yen on Wednesday in Tokyo. The euro, meanwhile, fetched 128.03-04 yen against 127.98-128.08 yen in New York and 128.10-14 yen in late Wednesday afternoon trade in Tokyo.

OFFSHORE MARKET NEWS: US share market closed down on Wednesday, as the Federal Reserve lifted interest rates as expected, even as the central bank signalled it expects slower rate increases next year. While the Fed also forecast fewer than previously estimated rate hikes next year, the central bank's tone was not as dovish as some traders had hoped. The Dow tumbled 351.98 points or 1.5% to 23,323.66, the Nasdaq plummeted 147.08 points or 2.2% to 6,636.83 and the S&P 500 slumped 39.20 points or 1.5% to 2,506.96.

0 thoughts on “Japan Nikkei tumbles on soft offshore lead ahead of BOJ decision”