Headline indices of the Japan share market tumbled on Friday, 04 January 2019, the first trading day of 2019, on tracking negative lead from Wall Street overnight after weaker than expected US manufacturing data and downwardly revised guidance from Apple, and anxiety about global growth after poor data from China and Europe earlier this week. All 33 subindexes of the Tokyo Stock Exchange's except the electric power and gas sector were in negative territory, with shares in Precision Instruments, Electric Appliances, Machinery, Chemicals, Metal Products, Glass & Ceramics Products, and Nonferrous Metals being notable losers. In late afternoon trades, the 225-issue Nikkei index tumbled 607.37 points, or 3%, at 19,407.40. The broader Topix index of all First Section issues on the Tokyo Stock Exchange dropped 33.58 points, or 2.25%, to 1,460.51. Tokyo markets were closed from Monday to Thursday for the holidays.

Market instability has extended into the new year, as concerns towards the U.S. and Chinese economies have increased in the wake of weak manufacturing data from these countries. Furthermore, the markets have even begun pricing in the possibility of Fed cutting interest rates. Wednesday's China Caixin/Markit Manufacturing Purchasing Managers' Index (PMI) marked the first contraction since May 2017 and Thursday's Institute for Supply Management (ISM) data showed U.S. factory activity in December suffer the biggest drop since October 2008. Apple on Wednesday took the rare step of cutting its quarterly sales forecast, blaming slowing iPhone sales in China.

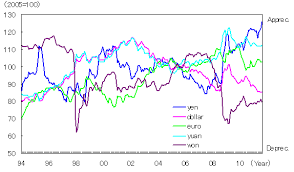

Exporters particularly chipmakers that make components used in smartphones and other gadgets suffered heavy losses, after Apple's revenue warning, and as of stronger yen. The Japanese currency was above 110 yen to the dollar a week ago but last traded at 107.58. Murata Manufacturing Co lost 10.6%, Nitto Denko Corp fell 5.7%, TDK Corporation dropped 6.6% and Alps Alpine was down 6.8%. Honda Motor Co lost 1.7%, Bridgestone Corp declined 2.4% and Subaru retreated 5.1%.

Exporter companies that derive a large portion of their sales in China also slipped. Industrial machinery maker Komatsu fell 3.9%, robot manufacturer Fanuc dropped 5.9% and cosmetics company Shiseido Co shed 7.1%.

On the economic front, Japan manufacturing sector continued to expand in December, with a PMI score of 52.6, the latest survey from Nikkei revealed on Friday. That's up from the 15-month low of 52.2 in November, and it moves further above the boom-or-bust line of 50 that separates expansion from contraction. Also, business optimism fell to its lowest level since November 2016.

CURRENCY NEWS: The Japanese yen, which can be a haven during market uncertainty, appreciated in the upper 107 yen zone against dollar on Friday. The dollar was quoted at 107.86-87 yen compared with 107.65-75 yen in New York on Thursday. The euro, meanwhile, fetched 122.85-86 yen against 122.56-66 yen in late Thursday afternoon trade in New York.

OFFSHORE MARKET NEWS: US share market closed steep lower on Thursday, due to weaker than expected US manufacturing data and downwardly revised guidance from Apple. The rare warning of disappointing results from Apple sent a shudder through the market and reinforced fears among investors that the world's second-largest economy is weakening. A weak report Thursday on U.S. manufacturing also weighed on the market. The Institute for Supply Management said its index of manufacturing fell to its lowest level in two years, and new orders have fallen sharply since November. Manufacturing is still growing, but at a slower pace than it has recently. Growing signs of a slowdown in China weighed on the market, as did the U.S.-China trade dispute, which threatens to snarl multinational companies' supply lines and reduce demand for their products. Investors were also unsettled by a report Thursday that showed signs of weakness in U.S. manufacturing. The Dow Jones Industrial Average tumbled 660.02 points or 2.8% to 22,686.22, the Nasdaq plunged 202.43 points or 3% to 6,463.50 and the S&P 500 slumped 62.14 points or 2.5% to 2,447.89.

Crude oil prices edged higher. U.S. crude rose 0.6% to $46.84 a barrel in New York and Brent crude rose 0.7% to $55.33 a barrel in London. Oil prices have nosedived almost 40% since early October, and investors' fears about falling demand in China and elsewhere were a key reason for the decline.

0 thoughts on “Japan Nikkei tumbles on growth woes yen appreciation”