Headline indices of the Japan share market were higher on Monday, 26 November 2018, as investors took heart from a slightly cheaper yen which supported buying of export-related issues. However, market gains were capped amid negative news such as a weak finish of Wall Street on last Friday, drop in oil prices sparked global growth worries, and the US-led trade war. Among TSE33 issues, shares in Warehousing and harbor transportation service, rubber product, and consumer credit-linked issues being notable gainers. In late afternoon trades, the 225-issue Nikkei index rose 145 points, or 0.67%, at 21,791.57. The broader Topix index of all First Section issues on the Tokyo Stock Exchange was up 4.31 points, or 0.26%, to 1,633.27.

Crude oil prices traded near their lowest levels since October last year, having dived 8% on Friday for the biggest weekly losses in nearly three years, with rising US production intensifying fears of a supply glut. The rout in crude oil intensified concerns about surging supplies and weak demand growth drove prices sharply lower. In Monday trade, US crude futures fetched $US50.53 per barrel, slightly higher though not far from Friday's low of $50.15. Brent crude futures last stood at $58.99 per barrel, near Friday's low of $58.41. On last Friday, West Texas Intermediate (WTI) futures for January settlement plunged $4.24, or 7.8%, to $50.39 a barrel on the New York Mercantile Exchange, while Brent, the global crude benchmark, fell $3.80, or 6.1%, at $58.80 a barrel in London. So far this month, WTI and Brent futures were down more than 21%, on track for their biggest fall since October 2008.

Markets are also bracing for a crucial meeting between US and Chinese leaders at the end of the week as trade tensions between the economic superpowers showed no signs of easing.

Shares of export-related issues gained, on the back of yen's retreat against the U.S. dollar. The dollar was trading at 112.92 yen in Asian trade, against 112.90 yen in New York on Friday. Among exporters, game giant Nintendo was up 3% and Bridgestone was up 2.3%. Nissan rose 0.5% as its president prepared to speak to employees about its former chairman Carlos Ghosn's arrest. Mitsubishi Motors was up 1.2% ahead of its emergency board meeting, which is widely expected to sack Ghosn as chairman.

ECONOMIC NEWS: Japan manufacturing sector continued to expand in November, albeit at a slower pace, the latest survey from Nikkei showed on Monday with a preliminary manufacturing PMI score of 51.8. That's down from the six-month high score of 52.9 in October, although it remains above the boom-or-bust line of 50 that separates expansion from contraction. Individually, new orders, backlogs, stocks of purchases and stocks of finished goods all contracted in November.

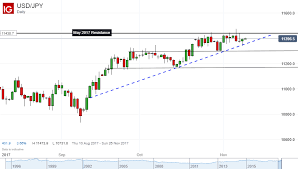

CURRENCY NEWS: Japanese yen depreciated in the upper-112 yen zone against greenback on Monday. The dollar was trading at 112.92 yen in Asian trade, against 112.90 yen in New York on Friday.

OFFSHORE MARKET NEWS: Wall Street stocks resumed their downward slide in a holiday-shortened session on Friday (Nov 23) as a sharp drop in oil prices sparked global growth worries. The Dow Jones Industrial Average finished down 0.7% at 24,285.95. The broad-based S&P 500 also shed 0.7% to 2,632.56, while the tech-rich Nasdaq Composite Index slid 0.5% to 6,938.98.

The major European markets turned in a mixed performance on Friday. The U.K.'s FTSE 100 Index edged down by 0.1%, while the French CAC 40 Index rose by 0.2% and the German DAX Index climbed by 0.5%.

0 thoughts on “Japan Nikkei gains 0 7”