Key indices hovered in a small range with negative bias in mid-afternoon trade. At 14:28 IST, the barometer index, the S&P BSE Sensex, was down 93.47 points or 0.26% at 36,390.86. The Nifty 50 index was down 30.15 points or 0.27% at 10,937.15. FMCG stocks declined. Profit booking after seven straight days of gains and negative global stocks weighed on the sentiment.

Domestic stocks opened on a subdued note as the key benchmark indices dropped on negative Asian stocks. Stocks extended fall in morning trade. Key indices cut some losses in mid-morning trade. Indices hovered in a small range in early afternoon trade. Key indices pared losses in afternoon trade.

The S&P BSE Mid-Cap index was up 0.11%. The S&P BSE Small-Cap index was up 0.19%.

The market breadth, indicating the overall health of the market, turned negative from positive. On the BSE, 1183 shares rose and 1292 shares fell. A total of 167 shares were unchanged.

Vedanta (down 2.27%), Bharti Airtel (down 1.85%), Wipro (down 1.53%), Maruti Suzuki India (down 1.47%), and Axis Bank (down 1.24%) were the major Sensex losers.

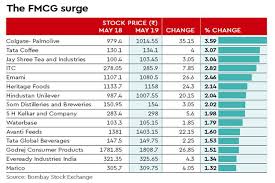

FMCG stocks declined. Britannia Industries (down 1.24%), GlaxoSmithkline Consumer Healthcare (down 0.42%), Colgate-Palmolive (India) (down 0.17%), Dabur India (down 3.27%), Godrej Consumer Products (down 1.82%), Hindustan Unilever (down 0.76%), Marico (down 3.17%), Tata Global Beverages (down 0.02%), Jyothy Laboratories (down 0.45%) fell. Nestle India (up 0.19%), Procter & Gamble Hygiene and Health Care (up 0.27%) and Bajaj Corp (up 2.72%) rose.

Meanwhile, Rajasthan chief minister Ashok Gehlot Wednesday reportedly announced waiver of short-term loans taken by farmers from cooperative banks and loans of up to Rs 2 lakh from other banks. The waiver will apply to loans taken up to November 30. The move is line with the action taken by the governments in Madhya Pradesh and Chhattisgarh, the two other states where the Congress won the recent assembly elections.

Overseas, European and Asian stocks declined Thursday after the US Federal Reserve raised rates for the fourth time in 2018. A Bank of England interest rate decision is due Thursday.

The Bank of Japan kept its monetary policy unchanged on Thursday, maintaining that the nation's economic expansion remains intact despite increased market volatility and the trade war between the US and China.

US stocks dropped on Wednesday after Jerome Powell failed to quell investor angst that the Federal Reserve's tightening policy will throttle economic growth. Investors had anticipated a less aggressive approach amid concern that global growth is slowing.

The US Federal Reserve raised interest rates on Wednesday, as expected, but forecast fewer rate hikes next year and signaled its tightening cycle is nearing an end in the face of financial market volatility and slowing global growth. The rate hike, the fourth of 2018, lifted the target range for the Fed's benchmark overnight lending rate by a quarter of a percentage point to a range of 2.25% to 2.50%.

In economic data, the Commerce Department reported that the US trade deficit increased to $124.8 billion in the third quarter, up from $101.2 billion the second quarter of 2019.

0 thoughts on “FMCG stocks slide”