Headline indices of the Mainland China equity market were higher on Tuesday, 27 November 2018, as investors risk sentiments underpinned after stock exchanges published draft rules that facilitate share buybacks by listed firms. However, market gains capped on caution before crucial meeting between US and Chinese leaders at the end of the week. In afternoon trades, the benchmark Shanghai Composite Index added 0.42%, or 10.94 points, to 2,586.75, meanwhile the Shenzhen Composite Index, which tracks stocks on China's second exchange, added 0.62%, or 8.26 points, to 1,339.19. The blue-chip CSI300 index rose 0.43%, or 13.47 points, to 3,154.71.

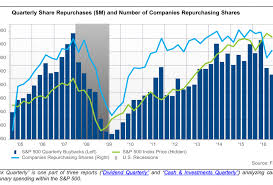

The Shanghai and Shenzhen stock exchanges had published draft rules late on Friday that would allow companies to use various channels, including borrowing and preferred share issuance, to fund share buybacks. Listed companies will also be allowed to sell stakes six months after share buybacks. The measures will likely incentivise more companies to buy back their shares in a boost to stock prices.

Investors are looking ahead to the Group of 20 summit beginning Friday when President Donald Trump and Chinese President Xi Jinping are expected to meet and discuss trade issues. The summit will be watched closely for how relations between both countries develop, in addition to further news surrounding Sino-US trade. China's main goal at the G20 meeting is to get the United States to refrain from raising the tariffs in January.

Many investors remained cautious due to economic uncertainty. China's economic growth is expected to hit 6.6% this year and slow to 6.3% in 2019 as the country struggles with challenges relating to trade and structural reform, economists from Beijing's Renmin University said in a report.

Investors also became cautious after China's Ministry of Industry and Information Technology said that the total profit of software and information technology service industry declined 4.6% in October compared with the same month last year. This marks the first month of a decline in industry profit.

Further, sentiments also muted after a report from the China Iron and Steel Industry Association stated that pressure on the supply side would remain. In October, China's daily output of crude steel averaged 2.66 million tons, a drop of 1.19% from the previous month. The Association said that as winter is usually a slow season, local enterprises need to carefully analyze changes in demand to ensure the steady operation of the market.

NEWS FROM THE PRESS: Steel prices tumble to five-month low—China's steel prices tumbled more than 5% to a five-month low on Monday, as persistent worries over weaker demand pushed the sector into a bear market, sparking a selloff in raw materials of iron ore and coking coal. The most actively traded rebar contract on the Shanghai Futures Exchange fell as far as 3,496 yuan (US$504) a ton, its lowest since June 26 and losing 21% since hitting a seven-year peak of 4,418 yuan in August. As China dials down on anti-smog production curbs this winter, steel supply in the world's top producer and consumer of the material had been rising while demand is weaker as the cold weather slows the construction sector. The concern among many is consumption may not recover strongly in the spring with China's economy under pressure from faltering consumer spending and property sales, and with Chinese exports to the United States expected to slide soon as higher U.S. duties start to bite. Steel traders are not replenishing stockpiles on concerns demand could remain weak, with the Chinese economy cooling further amid an ongoing trade spat with the United States. Rebar stocks at traders dropped to 3.08 million tons in mid-November, the lowest level this year, according to data tracked by SteelHome.

Economic growth seen slowing to 6.3% next year-- The country's economic growth is expected to hit 6.6% this year and slow to 6.3% in 2019 as the country struggles with challenges relating to trade and structural reform, economists from Beijing's Renmin University said in a report. The predictions, published by the news service of the China Academy of Social Sciences, are in line with the median forecast in a poll of 73 economists last month, with China under increasing pressure from a trade war with the United States. But the economists with Renmin University's School of Economics warned that China would still face difficulties even if trade tensions with the United States were resolved, with the country facing a deteriorating global trade environment, falling export growth and currency depreciation. China's gross domestic product (GDP) grew 6.5% year on year in the third quarter of the year, its slowest quarter of growth since 2009, and the government has tried to encourage commercial banks to boost lending to private firms and take action to ease company financing problems. The economists said it would be difficult to use short-term measures to alleviate downward economic pressures now building in China, and while recent policies should prevent a deeper decline in growth next year, a new round of structural supply-side reforms was needed. They predicted that 2019 would be critical in the restructuring of China's economy and its long-term transition to a slower and more high-quality growth model. The report said next year should also see a rebalancing of China's foreign trade, with imports likely to soar 16.1%, compared with a 6.1-percent rise in 2018. The report said Chinese consumer spending was expected to rise 9% next year, outpacing overall growth.

CURRENCY NEWS: China yuan depreciated against greenback on Tuesday, after central bank set softer mid-point rate. Prior to market opening, the People Bank of China set central parity rate at 6.9463 per US dollar, weaker by 10 basis points from previous day mid-point rate. In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2% from the central parity rate each trading day.

OFFSHORE MARKET NEWS: Wall Street stocks closed higher on Monday, rebounding from four consecutive days of losses, as retail shares rallied on expectations of strong sales as shoppers went hunting for deals on Cyber Monday. Stable oil prices and global equities gains also soothed sentiment after a bruising week of losses. The Dow Jones Industrial Average climbed 354.29 points, or 1.5%, to 24,640.24. The broad-based S&P 500 rose 40.89 points, or 1.6%, to 2,673.45, while the tech-rich Nasdaq Composite Index rallied 142.87 points, or 2.1%, to 7,081.85. Last week, the Nasdaq tumbled 4.3%, the Dow fell 4.4% and the S&P 500 slid 3.8%, marking the worst Thanksgiving week since 2011 for all three indexes.

The major European markets also rallied on Monday, as investors digested fresh developments surrounding the U.K.'s withdrawal process from the EU. Over the weekend, leaders from the European Union chose to endorse the Brexit withdrawal deal laid out by U.K. Prime Minister Theresa May. The German DAX Index spiked by 1.5%, the U.K.'s FTSE 100 Index surged up by 1.2%, and the French CAC 40 Index jumped by 1%.

0 thoughts on “China Stocks gains on buybacks”