Mainland China equity market closed down on Tuesday, 22 January 2019, as investors took profits from recent gainers amid mounting worries about global growth after the International Monetary Fund on Monday cut its world economic growth forecasts for 2019 and 2020 due to weakness in Europe and some emerging markets, and said failure to resolve trade tensions could further destabilise a slowing global economy. The IMF's downgrade came hours after China reported its weakest quarterly growth since the financial crisis and its slowest annual expansion in 28 years, with further cooling expected this year. At closing bell, the benchmark Shanghai Composite Index declined 1.2%, or 30.81 points, to 2,579.70. The Shenzhen Composite Index, which tracks stocks on China's second exchange, was down 1.17%, or 15.58 points, to 1,314.58. The blue-chip CSI300 index lost 1.33%, or 42.32 points, to 3,143.32.

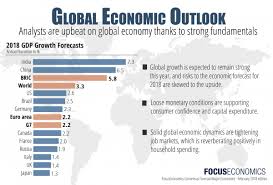

The International Monetary Fund has warned a further slowdown in global growth in the face of growing trade tensions. The Fund in its latest World Economic Outlook has downgraded its global growth forecast for 2019 to 3.5% and 3.6% for 2020 - 0.2% and 0.1% respectively below its previous prediction. The fund warned that Britain leaving the European Union without a deal and a greater than expected slowdown in China could spark a further deterioration in sentiment and hit global growth, exasperating risks already posed by the deterioration in US-China relations. The IMF called on countries to “resolve cooperatively and quickly their trade disagreements and the resulting policy uncertainty”, instead of raising barriers further and “destabilising an already slowing global economy”.

The IMF's warning came shortly after China reported its slowest growth in 28 years for 2018, amid the trade war with the United States and cooling domestic demand. Data on Monday showed fourth-quarter economic growth cooled to 6.4% on-year, the weakest since the global financial crisis. That dragged full-year 2018 growth to 6.6%, the weakest in 28 years.

On Monday, President Xi Jinping said China must be on guard against unforeseen but extreme 'black swan' risks while fending off 'grey rhino' events, which are highly obvious yet ignored threats. In response to the gloomy growth outlook, investors expect China to loosen monetary and fiscal policies to boost growth.

U.S. President Donald Trump attributed China's economic slowdown to U.S. trade policies in a tweet on Monday, and said it makes so much sense for China to finally do a Real Deal, and stop playing around. The two sides agreed to a 90-day truce in the trade war at the start of last December.

The largest percentage losses in the Shanghai index were China Securities Co, down 7.6%, followed by Qingdao Topscomm Communication Inc losing close to 7%, and Tonghua Dongbao Pharmaceutical Co down by 6.2%.

CURRENCY NEWS: The People's Bank of China set the yuan reference rate at 6.7854 vs the previous day's fix of 6.7774.

0 thoughts on “China Market falls on gloomy global growth outlook”