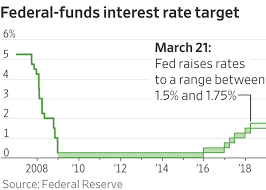

Headline indices of the Australian financial market fell to lowest level in two years on Thursday, 20 December 2018, as risk aversion selloff continued on tracking soft lead from Wall Street overnight after the US Federal Reserve raised rates, as expected, and kept most of its guidance for additional hikes next year, dashing investor hopes for a more dovish policy outlook. In late afternoon trade, the benchmark S&P/ASX200 index dropped 40.90 points, or 0.7%, to 5,539.70 points, while the broader All Ordinaries index shed 44.27 points, or 0.8%, to 5,605.70 points.

Gold stocks declined as the price of the precious metal fell on Wednesday after the U.S. dollar recovered following the Fed decision, with St Barbara and Evolution Mining down 3.5% and 2.4%, respectively.

Shares of financials wavered between positive and negative territory, a day after shareholders voted against the executive remuneration plans of two of Australia's biggest banks, Australia and New Zealand Banking Group and National Australia Bank. Shares of NAB and ANZ, were slightly lower at 0.1% and 0.3%, respectively, while the country's largest bank, Commonwealth Bank of Australia gained 0.2%.

Shares of energy sector were mixed. Among energy stocks, Santos rose 0.6%, while Oil Search was flat and Woodside Petroleum was lower by almost 1%.

Shares of materials and resources were up. Fortescue Metals added 0.2% and Rio Tinto rose 0.4%, while BHP Group was down 0.3%.

Among individual stocks, MYOB Group tumbled more than 10% after accounting software firm said it could not recommend a downwardly revised offer by KKR & Co, which lowered its bid for the company. U.S. private equity giant KKR & Co slashed a A$1.8 billion buyout proposal for Australian accounting software maker MYOB Group , a sign of the souring appeal of high-tech investments and sending the target's shares down. MYOB said it would reject an offer at the new suggested price of A$3.40 per share, from A$3.77 on Nov. 2. KKR first approached the company in October with a proposal to buy the 80% it did not already own for A$3.70.

In economic news, the Australian Bureau of Statistics said that the unemployment rate in Australia came in at a seasonally adjusted 5.1% in November. That exceeded expectations for 5%, which would have been unchanged from the October reading.

The Australian economy added 37,000 jobs last month - blowing away expectations for an increase of 20,000 jobs following the gain of 32,800 in the previous month.

CURRENCY: Australian Dollar edged down against greenback on Thursday, due to weak oil prices. The Australian dollar was quoted at $0.7114, down from $0.7193 on Wednesday.

OFFSHORE MARKET NEWS: US share market closed down on Wednesday, as the Federal Reserve lifted interest rates as expected, even as the central bank signalled it expects slower rate increases next year. While the Fed also forecast fewer than previously estimated rate hikes next year, the central bank's tone was not as dovish as some traders had hoped. The Dow tumbled 351.98 points or 1.5% to 23,323.66, the Nasdaq plummeted 147.08 points or 2.2% to 6,636.83 and the S&P 500 slumped 39.20 points or 1.5% to 2,506.96.

0 thoughts on “Australia Market extends losses after Fed rate signals”